It's OK to Put Off Retirement Savings Until You're Older - It's Easier Then...

Except it's not. It is actually harder, unless you get lucky.

Saving is Hard, Regardless of Age

I recently had a conversation with a friend who explained she had used an online retirement calculator, and it said she needed $2M to retire. Her reaction:

“How am I going to save $2M?”

The number is not important; yours may be higher or lower. But the sentiment is common. My statement back to her, a bit flippant but not wrong, was “you don’t save $2M, you save maybe $500K, wait for the stock market to rip like it did from 2010-2024, and now you have $2M”.

Retirement is a Time Value of Money Problem

The Time Value of Money (TVM) is the core financial concept that a dollar today is worth more than a dollar tomorrow, primarily because money available now can be invested to earn returns, and grow through compound interest. TVM uses formulas to calculate Present Value (PV) and Future Value (FV) to help individuals and businesses make sound financial decisions.

Future Value Defined

Future Value = (Present Value) * (1 + annual return)^(number of years)

Example: you expect 7% annual real return for 40 years. FV = $1 * (1 + 0.07)^40 = $14.97

Which means each dollar you spend at age 25 would have been worth $14.97 at age 65, in todays (or constant spending value) dollars. (Note that 7% is the long term average real return on the S&P500.)

(Real Return is nominal return minus inflation; dollars of constant value. We discussed real vs nominal returns in our post on Safe Withdrawal Rate; see that for more information.)

Saving Gets Easier as you Make More Money, Right?

You will likely be making more money in the future, so saving IS easier in that sense. But the later you wait, the more you have to save, and the question is whether or not you can save enough more in the time left.

How Much More Are You Likely to Make?

For most people, your real compensation will increase about a factor of 3 from the start of your career (early 20’s) to mid career (around 50). This is what I observed during my career, and is backed up by this ADP report; and that largely holds true across the income scale.

Beyond around age 50, real compensation actually starts to drop for most people. This can be for a number of reasons: people step away from higher pressure roles for quality of life, at that age you are likely working in an aging industry where compensation is lower, etc.

There are some who will break beyond this; most won’t.

Can You Save Enough Later In Life?

Now we know how TVM works, and that we will make around 3x our starting compensation at 50. How does that play out for getting to a given retirement savings versus the number of years of saving?

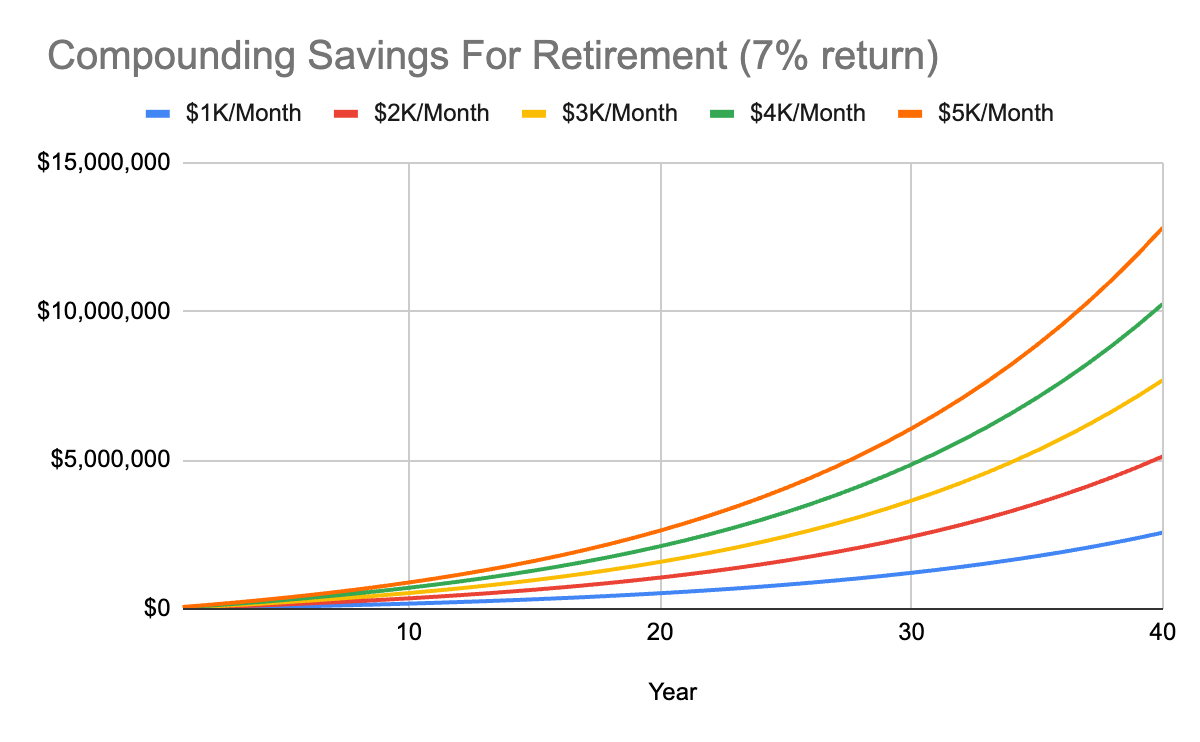

The chart above shows how a monthly savings of $1K-$5K, compounded at 7% return, for up to 40 years.

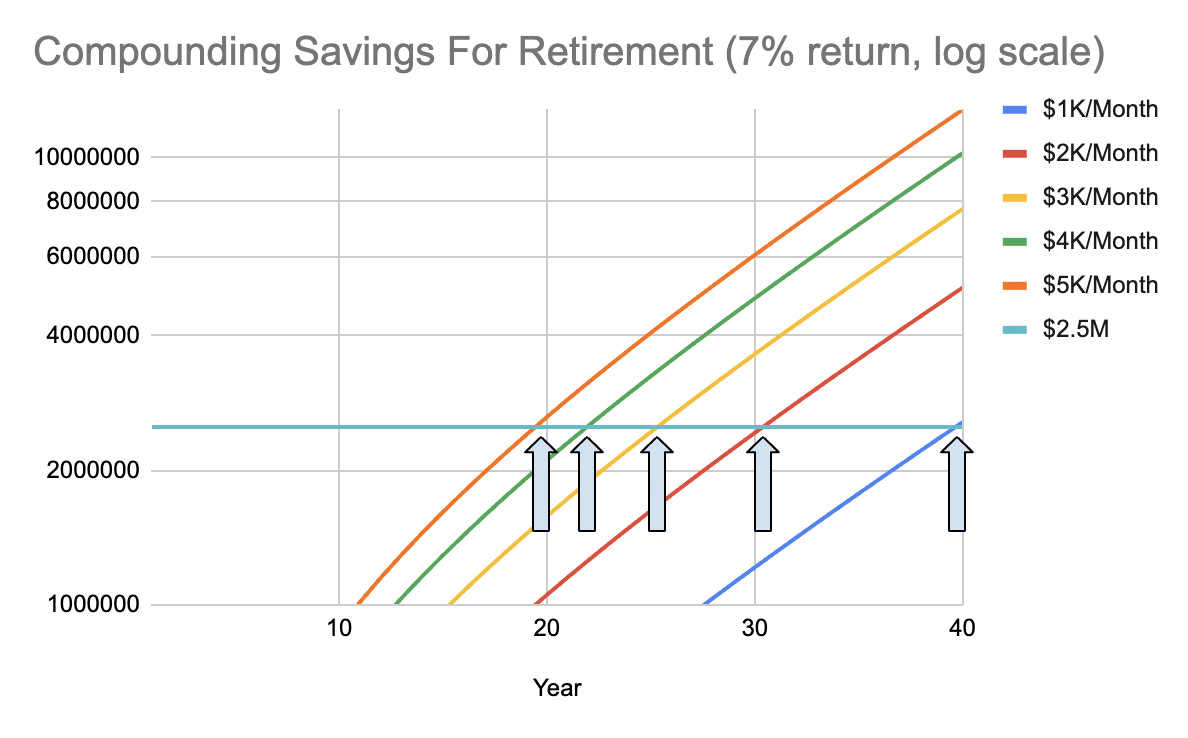

I’ve converted the first chart to use a log scale for $, zoom into account balances > $1M, and to add a line showing the $2.5M target.

Critical Idea: Note that as you move from right to left across the $2.5 line, the time between where the savings lines cross the $2.5M is getting shorter and shorter for constant changes in monthly contribution. (The arrows indicating the crossing points are closer together as you move right to left.) What this is saying is that the longer you wait to start saving, the amount you have to save each month is rapidly increasing.

Paths to $2.5M in Retirement

- Save $1000/month - after 40 years you have $2.56M.

- Save $2000/month - after 30 years you have $2.43M.

- Save $4000/month - after 22 years you have $2.52M.

- Save $5000/month - after 20 years you have $2.63M.

That last bullet drives home the Critical Idea above. An extra $1000/month savings reduces the time to $2.5M from 40 years to 30, but it also takes $1000/month more to reduce the time from 22 years to 20 years.

Saving Gets Harder The Longer You Wait.

Which seems easier:

- Save $1000/month starting early in your career.

- Save $5000/month starting mid-career.

Given that most people will only be making about 3X their early compensation when they reach mid-career, saving 5X seems much more difficult.

This is the result of TVM. Those early dollars saved generated free money.

How Much of the $2.5M Did You Save?

Another way to look at this is to determine how much of the final $2.5M came from your contributions to savings, versus how much was a result of investment returns.

- At the $1000/month for 40 years, you contributed $480K of the $2.5M.

- At the $5000/month for 20 years, you contributed $1.2M of the $2.5M.

Delaying Saving Makes it Harder

- $1 today is worth much more in the future: $3.9 (20 years), $7.6 (30 years), and $14.9 (40 years) with 7% real return

- You will likely be earning more mid-career than early career, by about 3x.

- However, due to TVM, if you delay saving for retirement you will have to save a significantly larger portion of your income to reach your goal.

While it is possible you will be someone who breaks way above the typical 3x mid-career compensation level, most won’t. Regardless of what people say, most don’t win in Vegas. Hope for the best, plan for the worst.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.