Safe Withdrawal Rate For Shorter Retirements

Not everyone needs a 30 year retirement. How does Safe Withdrawal Rate change for shorter retirements?

How Long is Retirement?

30 Years?

- 30 Years is a common assumption.

- The reasoning is that most people wait until they are eligible for Social Security and Medicare, which historically has been 65.

- Life expectancy past 65 is low. SSA (Social Security Administration) estimates that only 1 in 7 live to 95; that is 14%. (Reference: When to Start Receiving Retirement Benefits

Why it Might be Less?

- You worked until very late in life.

- You’re terminally ill.

- You’re only using retirement funds as a bridge to something else (inheritance, Social Security, pension, etc.)

This is Part Two - Please Read Part 1

If you haven’t read our prior posts on SWR and SWR Failure, please do so now. Those posts provides detail about the simulation and charts shown next.

Simulation Results

Reminder of what is shown…

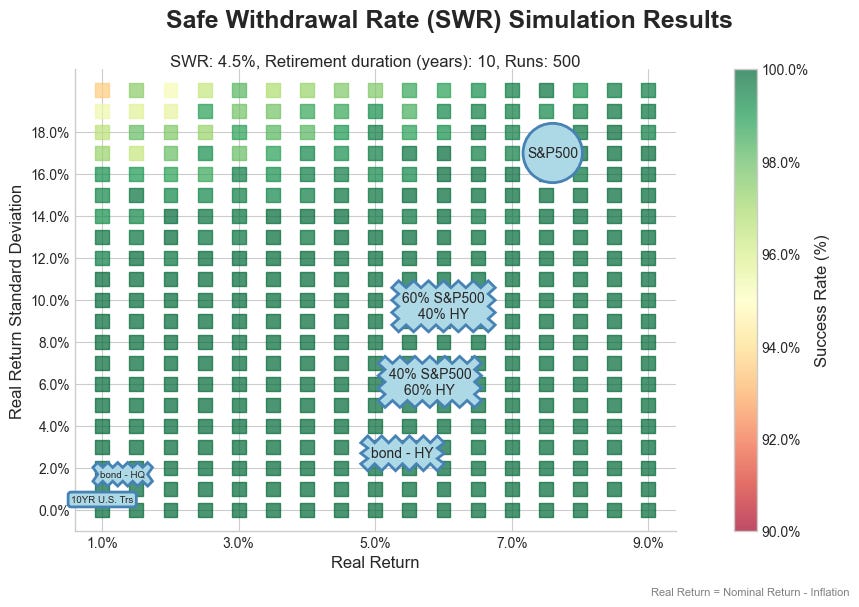

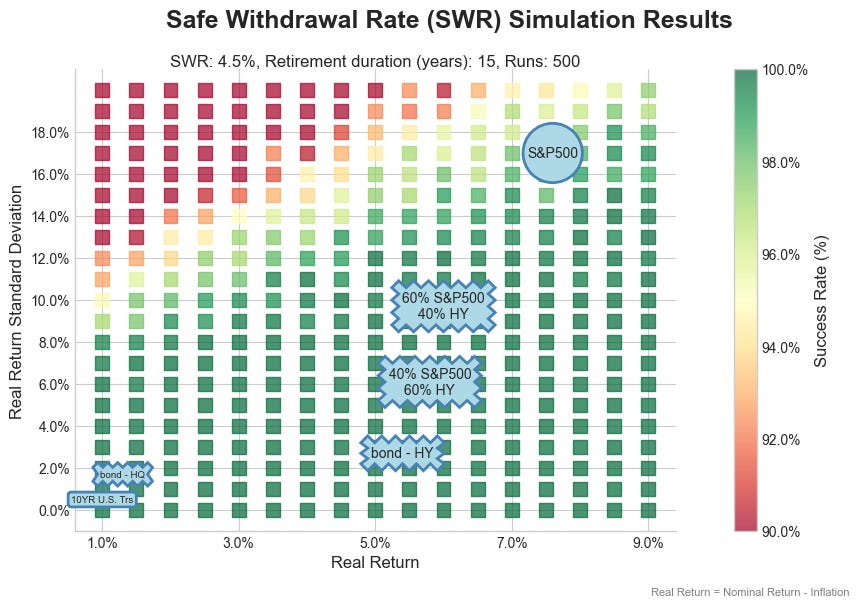

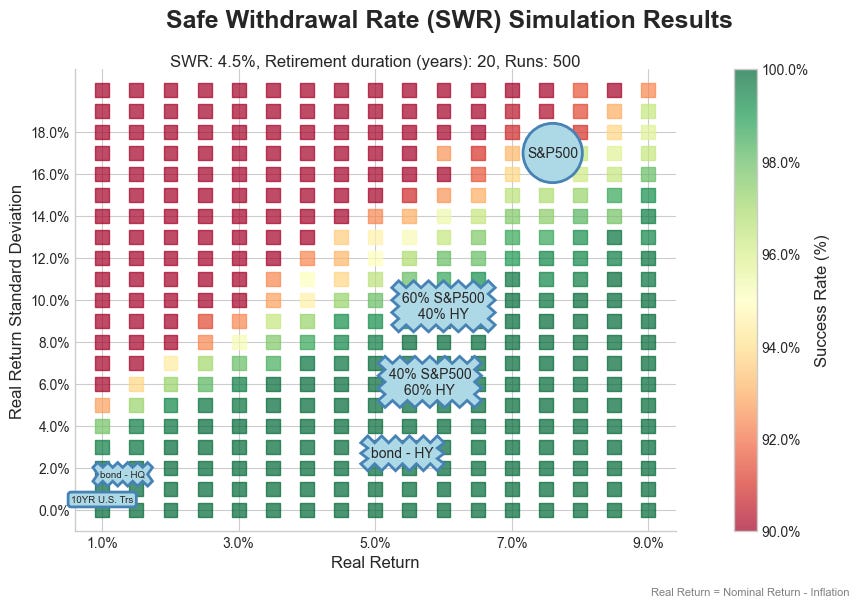

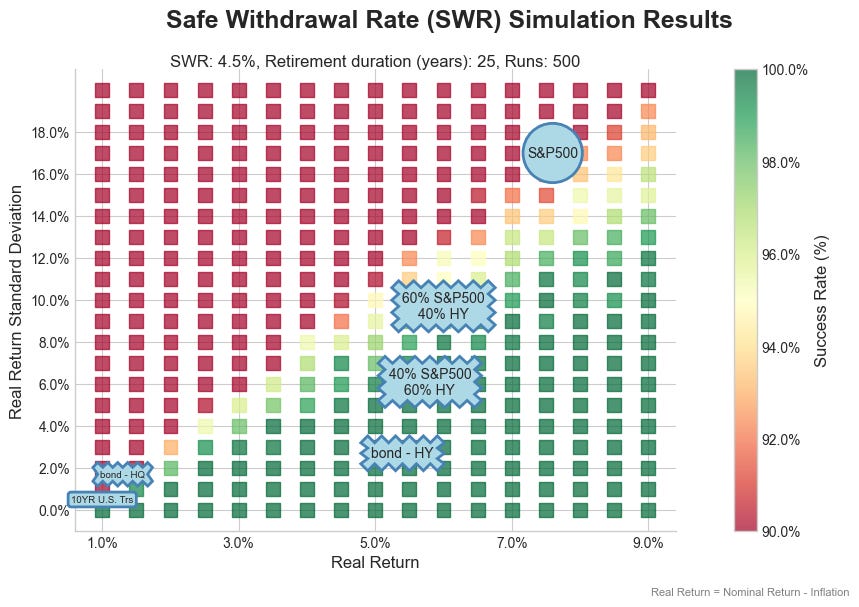

Heatmaps

- Red points indicate failure (the account ran out of money), green points indicate success.

- These are based on SIMULATED returns given an asset classes average return and stdev; these do use, not historical data.

Historical Data

- These charts show the real return for a given investment strategy versus time, based on historical data, with success/failure for a given retirement start mapped on top of that in read/green

Charts for a 4.5% SWR for 10, 15, 20 and 25 Year Retirements

See chart titles for details (SWR, retirement years, etc.)

SWR: 4.5%, Retirement Duration: 15 years

SWR: 4.5%, Retirement Duration: 20 years

SWR: 4.5%, Retirement Duration: 25 years

What these charts show

- For a retirement of 15 years or less, the investment space is largely “green”.

- For 20-25 years, investments with a stock profile (return and stdev) are becoming risky.

With an SWR of 4.5% being so successful for short periods, let’s look at a 6.0% SWR and 7.0% SWR for just 10-15 years.

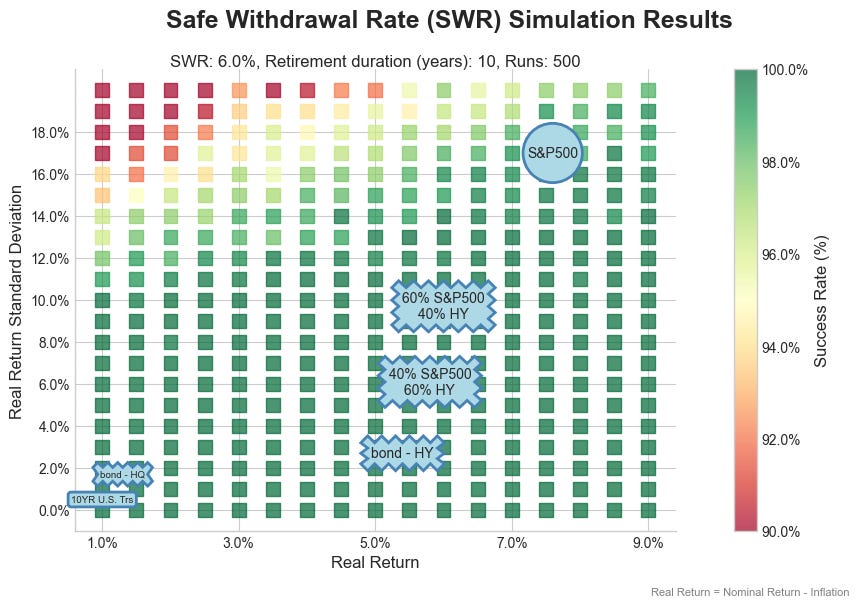

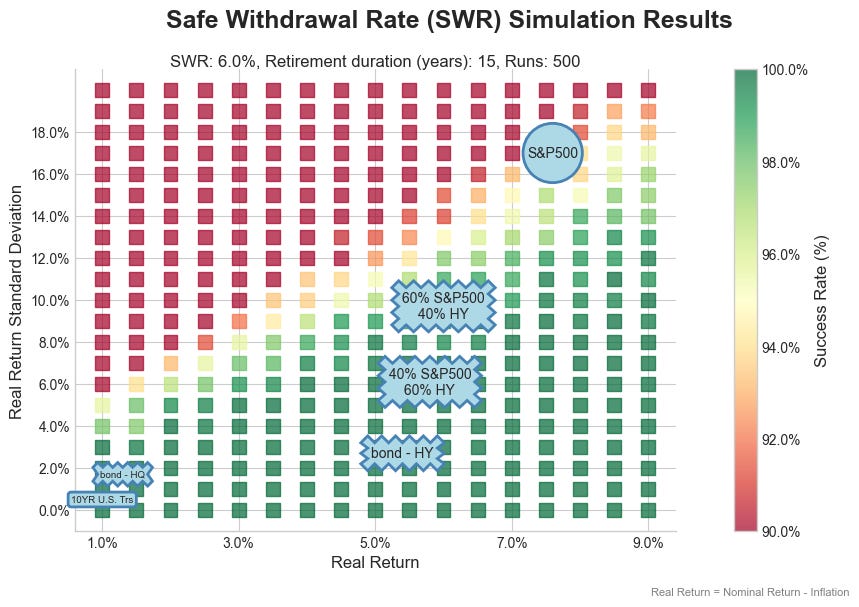

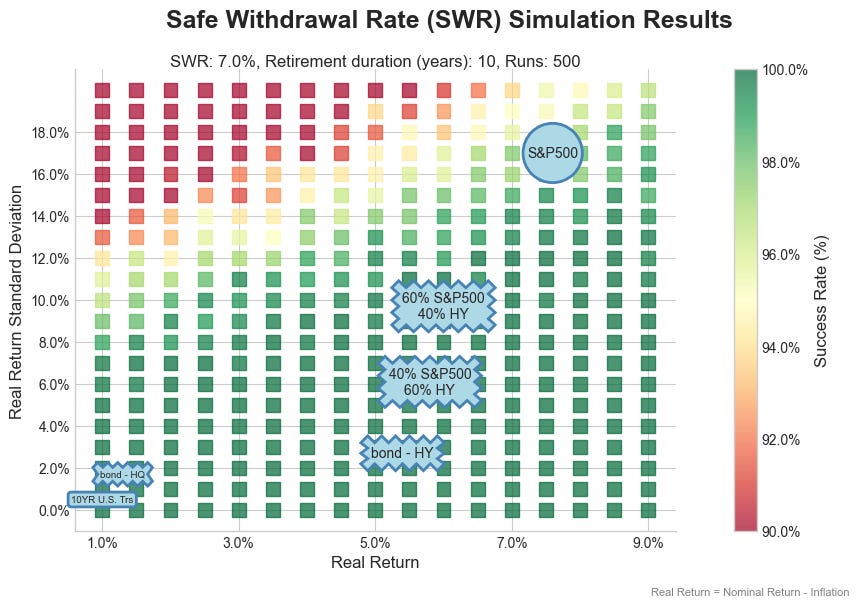

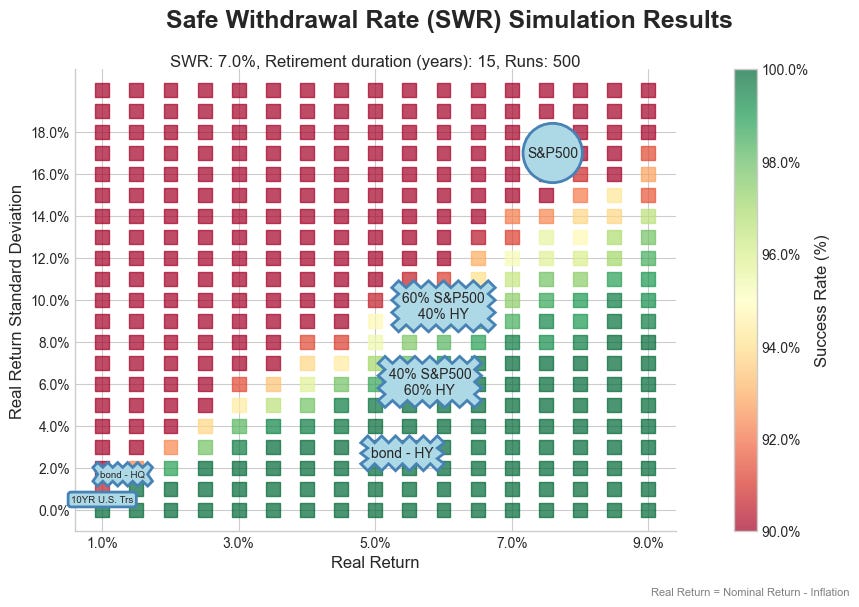

Charts for 6.0% and 7.0% SWR at Shorter Retirement Durations

See chart titles for details (SWR, retirement years, etc.)

6.0% SWR, Retirement Duration: 10 years

6.0% SWR, Retirement Duration: 15 years

7.0% SWR, Retirement Duration: 10 years

7.0% SWR, Retirement Duration: 15 years

What these charts show

As you might expect, the shorter retirement periods allow for substantially higher withdrawal rates.

The heatmaps use simulated data based on an asset classes real return and stdev. Let’s take a look at how some of these scenarios play out against historic data.

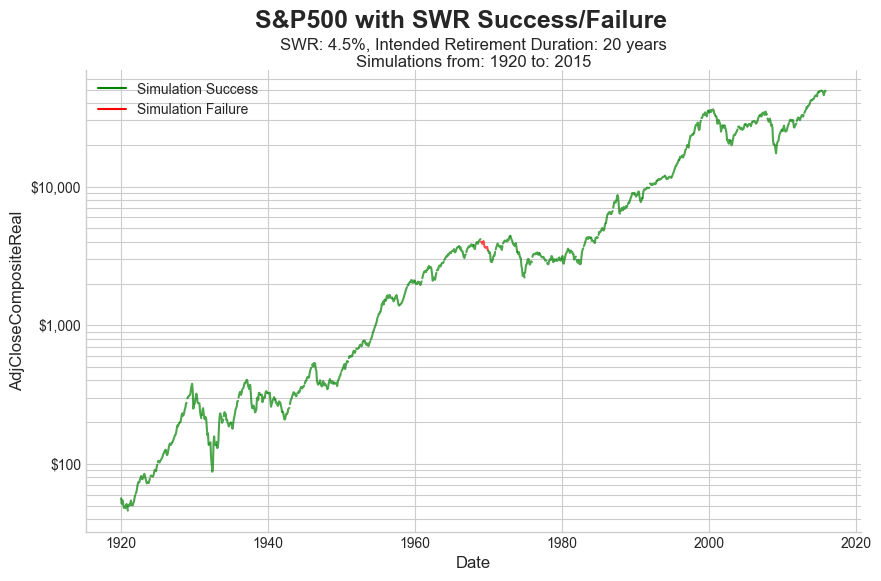

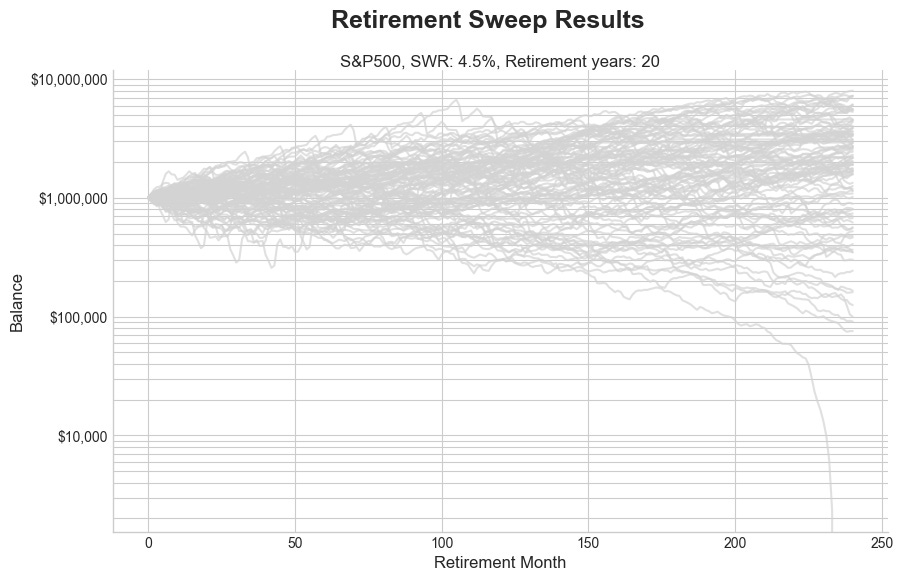

Historic Simulation - 20 Year Retirement, Starting in 1920, 4.5% SWR

See chart titles for details (SWR, retirement years, etc.)

These charts are for a 4.5% SWR, for a 20 year retirement, invested 100% in the S&P500. (We simulate a retirement for every year, starting in 1920, until 2015. For years after 2010, less than 20 years are simulated.)

- We ran a 15 year retirement and it had zero failures since 1920.

- The chart of real return for a 20 year retirement shows a single failure for retirement starting in 1969. (See red line segment in otherwise green line.)

- The balances chart (balances from each simulation starting in year 1920) shows the failure and some lower balances.

- 100% stocks is not a recommendation, but used to show that at this shorter retirement duration a portfolio can take more risk with a 4.5% SWR.

Running against historic data shows the portfolio was a bit more robust than when based on simulated returns.

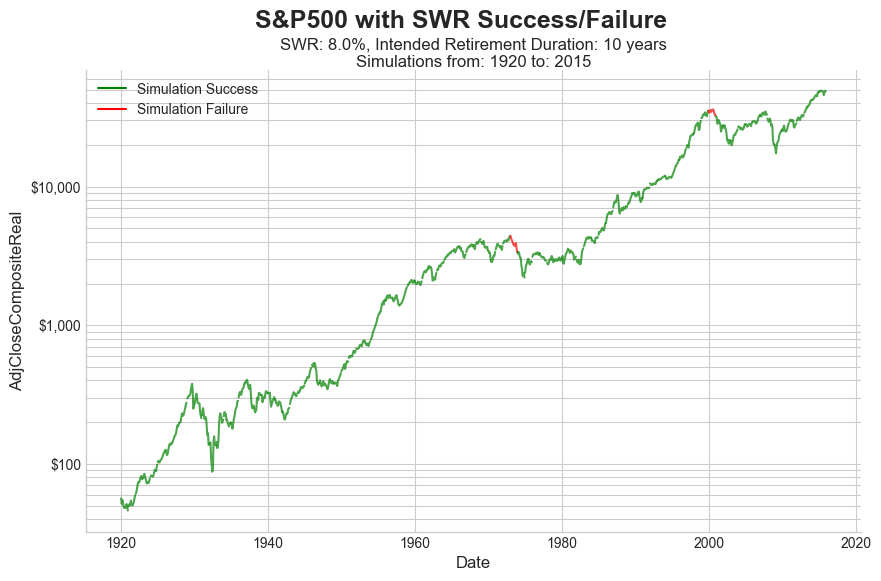

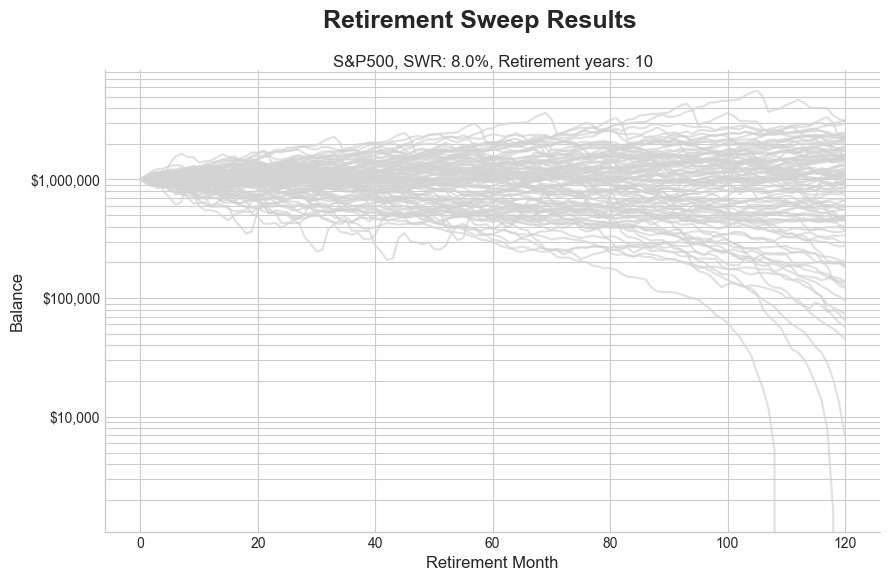

Historic Simulation - 10 Year Retirement, Starting in 1920, 8.0% SWR

See chart titles for details (SWR, retirement years, etc.)

These charts are for a 8.0% SWR, for a 10 year retirement, invested 100% in the S&P500. (We simulate a retirement for every year, starting in 1920, until 2015. For years after 2010, less than 20 years are simulated.)

- We ran a 10 year retirement at 7.0% SWR and it had zero failures since 1920.

- The 8.0% SWR chart of real return shows two failures for retirement starting in 1973 and 2000. (See red line segment in otherwise green line.)

- The balances chart (balances from each simulation starting in year 1920) shows the failures and some lower balances.

- Again, this is not a recommendation, but used to show that at this shorter retirement duration a portfolio can take more risk with a higher SWR.

Key Takeaways

- Retirement duration of less than 30 years may be appropriate for some.

- For these shorter durations, SWR can be increased, and the portfolios can withstand higher volatility.

“Just because you can, doesn’t mean you should”

Again - these are not recommendations. Just because simulations and historical data suggest you could take on more risk, doesn’t mean you should. The optimal approach is generally to take on the LEAST risk, at a real return required to get to the desired SWR.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.