U.S.-Based Investors Think the Worst-Case Scenario is the Great Depression or GFC. Other Countries Disagree.

When investment planning for retirement, it is important to consider all possible outcomes. We take a look at Japan in the 1990s to redefine "worst case".

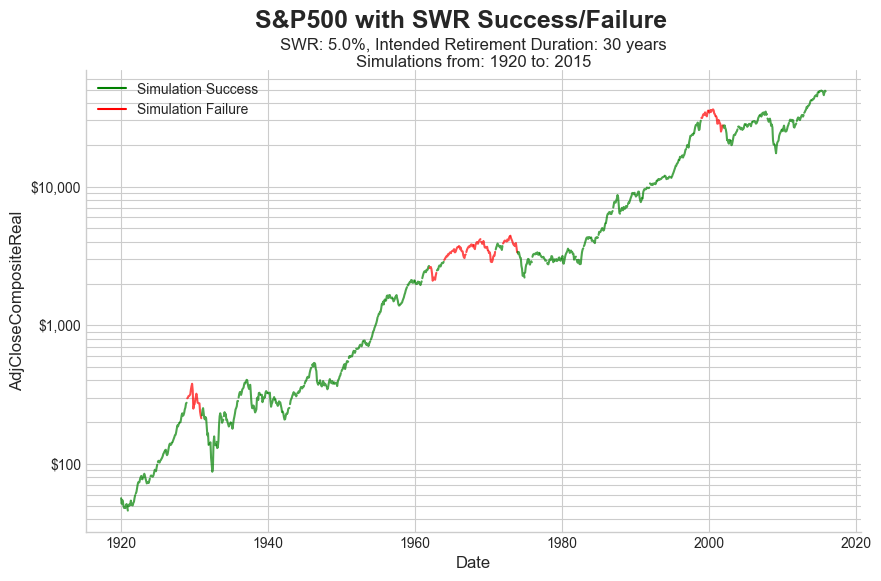

U.S.-based investors have had it quite good, for a long time. As we showed in our post “Safe Withdrawal Rate Failure”, using a fixed Safe Withdrawal Rate (SWR) of 5% and a 50%/50% stocks/bonds allocation would have been successful, except for retirements starting in: 1937, 1962-69 (most years), 1973, and 2000.

If you had used a 4.5% SWR with the same portfolio, there were zero failures.

Even if you were 100% stocks with a 5% SWR, there were only a few more failing years. (See above chart.) This has left U.S.-based investors confident in general, and confident in U.S. stocks in particular.

This historical data, or statistics derived from it, are used in models to determine Safe Withdrawal Rates. Thus the 4% Rule, now the 4.5% Rule, doesn’t fail against the prescribed 50/50 (stock/bond) portfolio. But does this data really represent a proper range of scenarios, including worst case?

It can be worse - Japan in the 90s

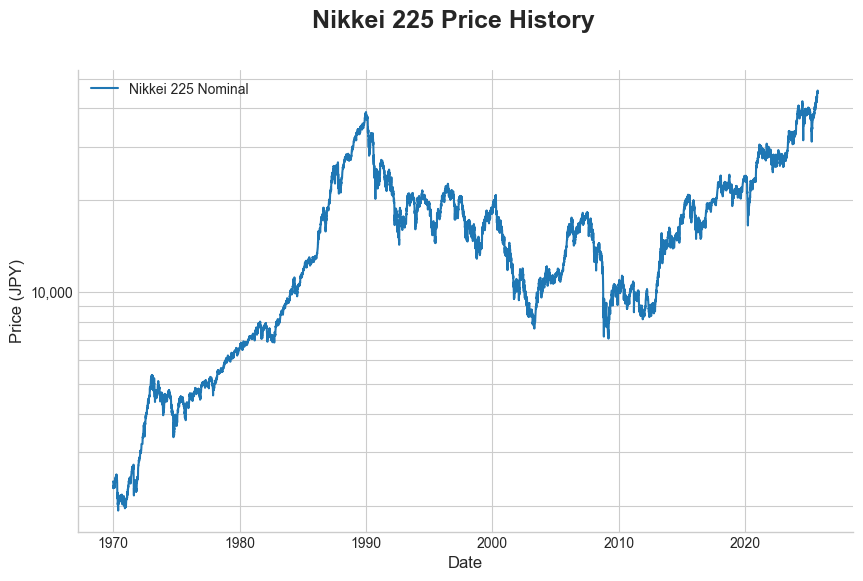

The chart above shows the Nikkei 225 (JAN 1970 - SEP 2025). The Nikkei 225 is roughly the Japanese equivalent of the S&P500, as it is the most prominent stock index tracking major Japanese companies on the Tokyo Stock Exchange, serving as a key economic barometer. (The Nikkei 225 and S&P500 differ significantly in calculation as the Nikkei 225 is price-weighted, while the S&P 500 is market-cap weighted.)

The obvious problems:

- The index peaked in December 1989 at ¥38,915, and didn’t see that level again until February 2024.

- The chart is nominal price; not inflation adjusted. That 1989 level represents about ¥47K in todays Japanese Yen. Thus, in real terms, the index only regained its 1989 peak in October 2025.

- From 1/1992 to 1/2020, the index averaged ¥15418, or 39% of its peak.

- It reached a low of ¥7054, or 18% of its peak.

Retirement Scenario Results

We are going to use the investment returns of the Nikkei 225, and treat them like a U.S.-based investor had this same return, just to show how a scenario like this plays out for retirement.

Let’s take an optimistic scenario. A person retires in January 1985, well prior to the peak. They believe in stocks, and thus stay invested 100% in stocks. They have 5 years where the account goes up over 200% (a factor of 3.12). That is an INCREDIBLE start; who could ask for better.

Yet, the results are bleak:

- With a 5% fixed withdrawal rate. Balance hits zero in 2004; retirement lasted 19 years.

- With a 3% fixed withdrawal rate. Balance hits zero in 2011; retirement lasted 26 years

-

With a 2% fixed withdrawal rate. Balance hits a low of about $90K in 2012, then recovers to about $120K in 2015 when the 30 year retirement ends. Just made it...

- Even though the index is recovering strongly after 2012, a longer retirement would have ended with $0 in 2022; the significant gains just weren’t enough on the reduced balance.

-

All that, and this was a scenario for retirement starting in 1985. Anyone retiring between 1985-1990 had it much worse.

Just to be clear on those results - it took living off of only 2% of the portfolio to last a 30 year retirement.

What would you have done?

It is valuable to contemplate such a scenario and ask yourself “what would I have done?”.

- You might think that not being 100% in stocks would have fixed it, but the results hardly change due to the huge run-up at the start of retirement that you would have missed in a mixed portfolio.

-

Go to international stocks? The 1990 Nikkei collapse was isolated to the Japanese market. But the downturn in the Nikkei in 2000 was the dot-com bust, and in 2008 the GFC took all markets with it.

- This is an example of really unfortunate timing. The local (Japanese) market collapses, then a decade later there are 2 market setbacks that are worldwide.

Takeaways

What can we learn from this?

-

Buy the dip!- Not every dip is a buying opportunity. It will work sometimes, otherwise you are trying to catch a falling chainsaw and it will take your hands off.

-

“It’s different this time, valuations don’t matter”.-

That was literally being said at the time about Japanese asset prices; both stocks and real estate.

-

Valuations matter. Maybe not today, or next month, but at some point they will matter again.

-

-

Buy and hold is appropriate for someone with very long time horizons. But your retirement may be shorter than the long term that justifies buy and hold.

- We are advocates for having a strategy to get out of stocks in such circumstances. There are different strategies, we will discuss that in a future post(s).

Last it is important to point out that most retirement calculators, safe withdrawal rate models, etc., don’t account for a scenario like this. Maybe this is an extreme case, and they shouldn’t account for a scenario like this. But it is important to know that even in recent history, in an advanced economy, asset collapses do happen.

Did we mention AI, or current U.S. asset prices? No. Our intention is not to debate the current situation, but just post a reminder that asset bubbles can happen, have happened not long ago, and they were driven with the same “but this time is different” or “valuations don’t matter” logic.

P.S. Wikipedia has a good write-up on the Japanese asset collapse. One of our favorite statistics from the era:

- “At their peak, prices in central Tokyo were such that the 1.15 square kilometer Tokyo Imperial Palace grounds were estimated to be worth more than the entire real estate value of California**”

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.