We recently had conversations with friends of the channel, one early in their FIRE journey and one late in their journey. Both are paying financial advisors, neither really understand the long term costs of their advisors. We will use this post, not to judge their choices, but to highlight the importance of understanding the long term costs of an advisor, which are substantial.

Why It Seems to Make Sense To Use an Advisor, Particularly Early in Your Journey

Early in your FIRE journey, it seems like an easy decision to use an advisor. You're not sure what to do with your money. There are many investment options; it seems complicated. But someone will do this for you, and charge about 1% of your assets per year. You do the math, that seems incredibly reasonable. (With $100K in your portfolio, that's $1000 per year; seems like a small price to ensure you are on the right path.)

Where The Decision Goes Wrong

There are a few issues with this decision.

- Early in your journey, the decision is relatively easy. Buy-and-hold is the recommended strategy. But buy-and-hold what? The answer is buy the whole stock market via an ETF (Exchange Traded Fund). We'll cover this in the conclusion with a recommendation to read a book on the subject. (Don't worry, it is a short read.) If you pay anyone, any amount, to do this for you, you are paying too much.

- Late in your journey, the decision is only slightly more complex. Now the answer is buy the whole stock market with a portion of your assets, and buy the whole bond market with the rest. Maybe you also add in some world-wide stock exposure. In all cases, you are buying ETFs with broad exposure. You can do this yourself, using just 3 ETFs. The same book mentioned above also covers this. Again, paying someone any amount to do this for you is paying too much.

What you will learn by reading the book is that few investors/advisors can outperform the market as a whole. You are generally better off buying broad index funds than paying for active management. If you are following that advice, buying the ETFs yourself is quite simple, and not worth the cost of an advisor.

Costs During Wealth Accumulation

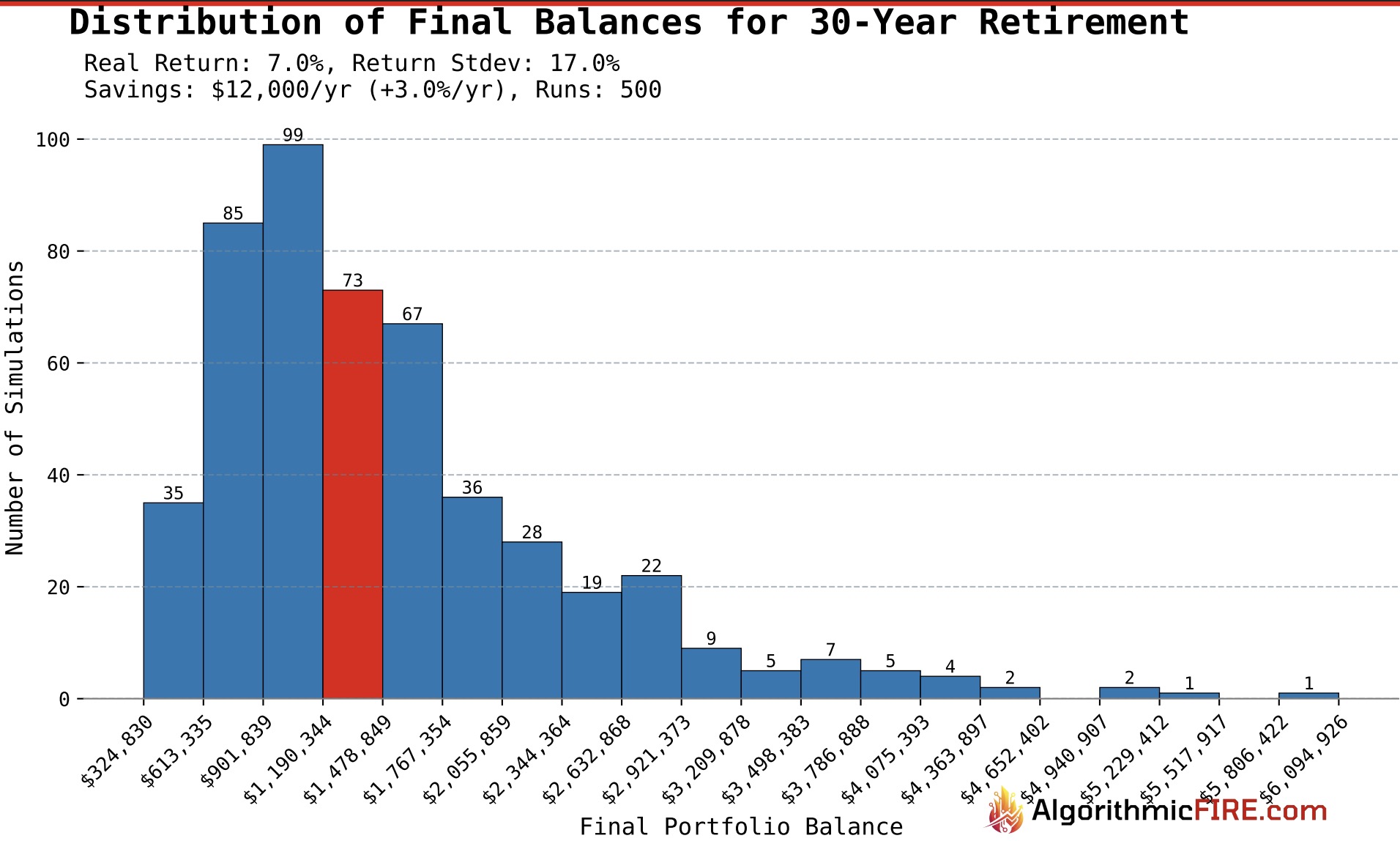

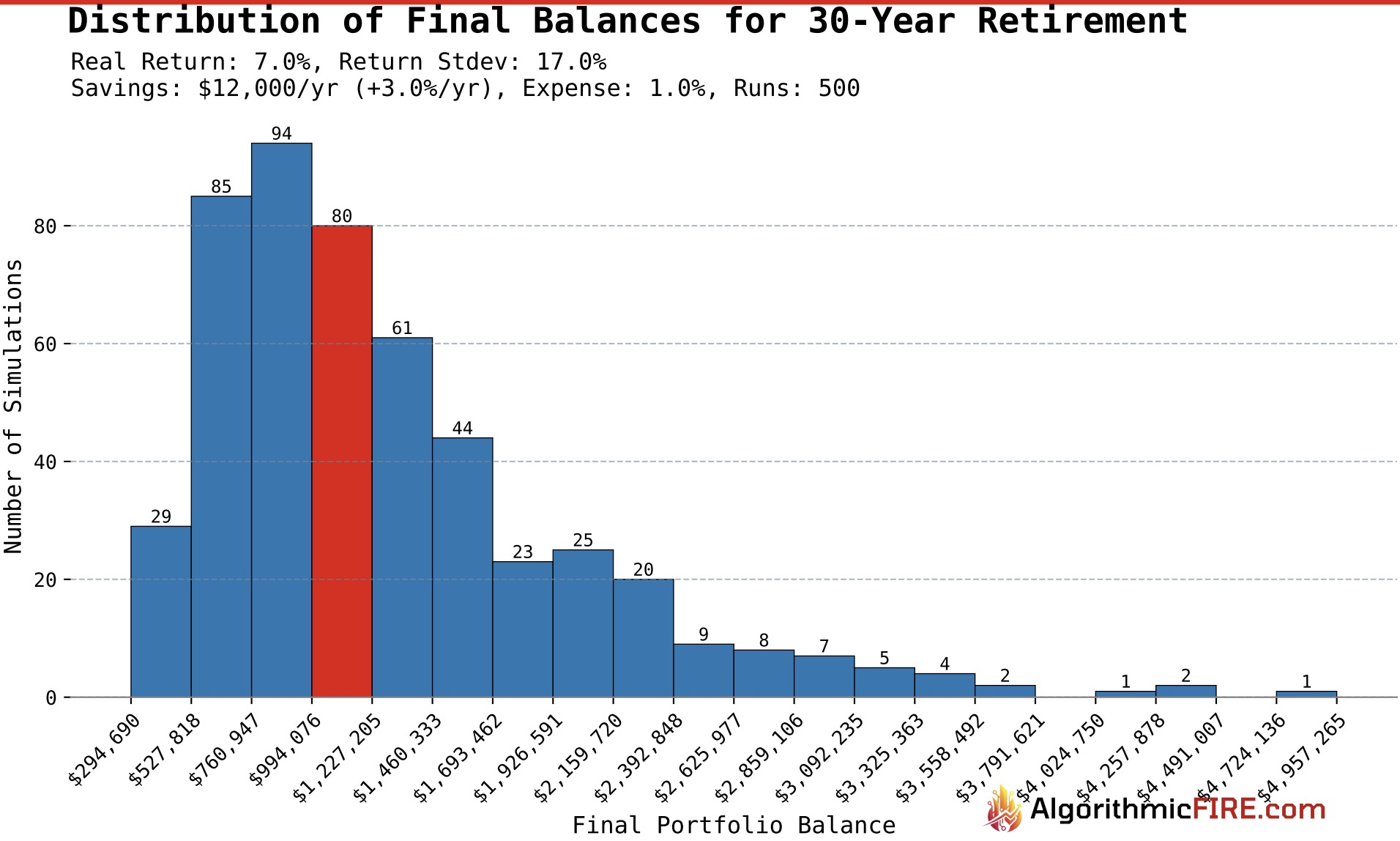

Let's take a look at what a 1% annual advisor fee means for your wealth while you are building your wealth. (We'll use the defaults to our Portfolio Wealth Simulator; start with 0 balance, save $12K/year, growing savings contributions 3%/year, save for 30 years.).

The calculator performs a Monte Carlo simulation of 500 runs. Each run a different sequence of returns is generated to simulate returns you might experience if invested 100% in stocks. These returns are then applied to your savings to simulate your wealth over the 30 years. The result is a histogram of possible outcomes.

The first chart above is without the advisor, the second chart is with the advisor.

- Median accumulated wealth without an advisor: $1.2M - $1.5M

- Median accumulated wealth with an advisor: $1.0M - $1.2M

Over the course of a 30 years savings period, the advisor cost you, on average, $200K-$300K.

To be clear, this is not saying that you paid the advisor the $200K-$300K. It is saying that the advisor cost you $200K-$300K in terms of the returns you received. Compound interest is powerful, but you reduced the compounding from 7%/year to 6%/year; which is a significant drag on your returns.

Costs During Retirement

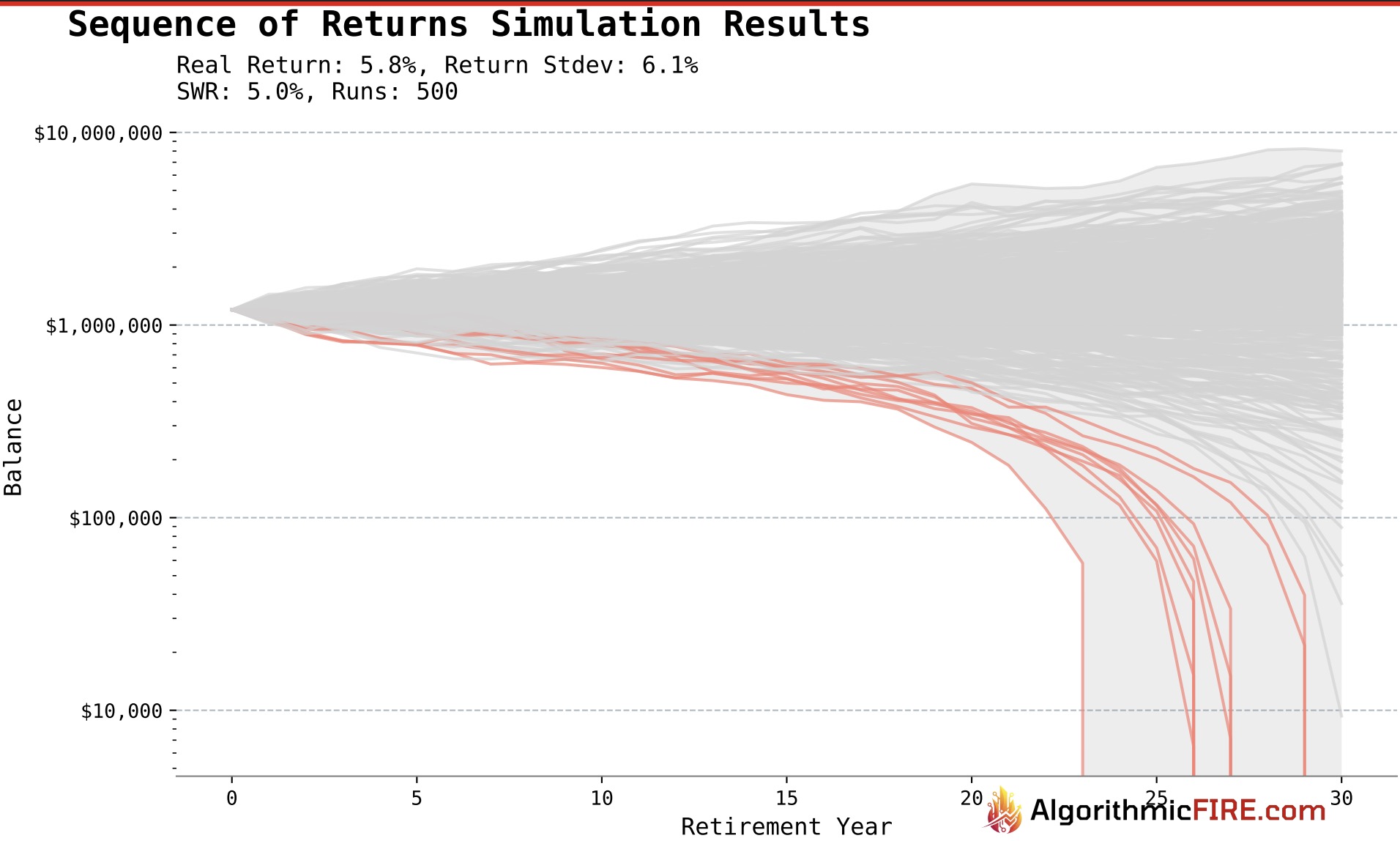

Now we'll use the same calculator to simulate retirement. We'll use the defaults to our Portfolio Wealth Simulator; except we'll start with $1.2M since that is near the median of the wealth accumulated in the previous simulation. The SWR (Safe Withdrawal Rate) of 5% means you retired with $60K/year of income.

Important point: This calculator is a fixed withdrawal rate calculator. That said, we ran the same analysis with a variable withdrawal rate, and the results were similar.

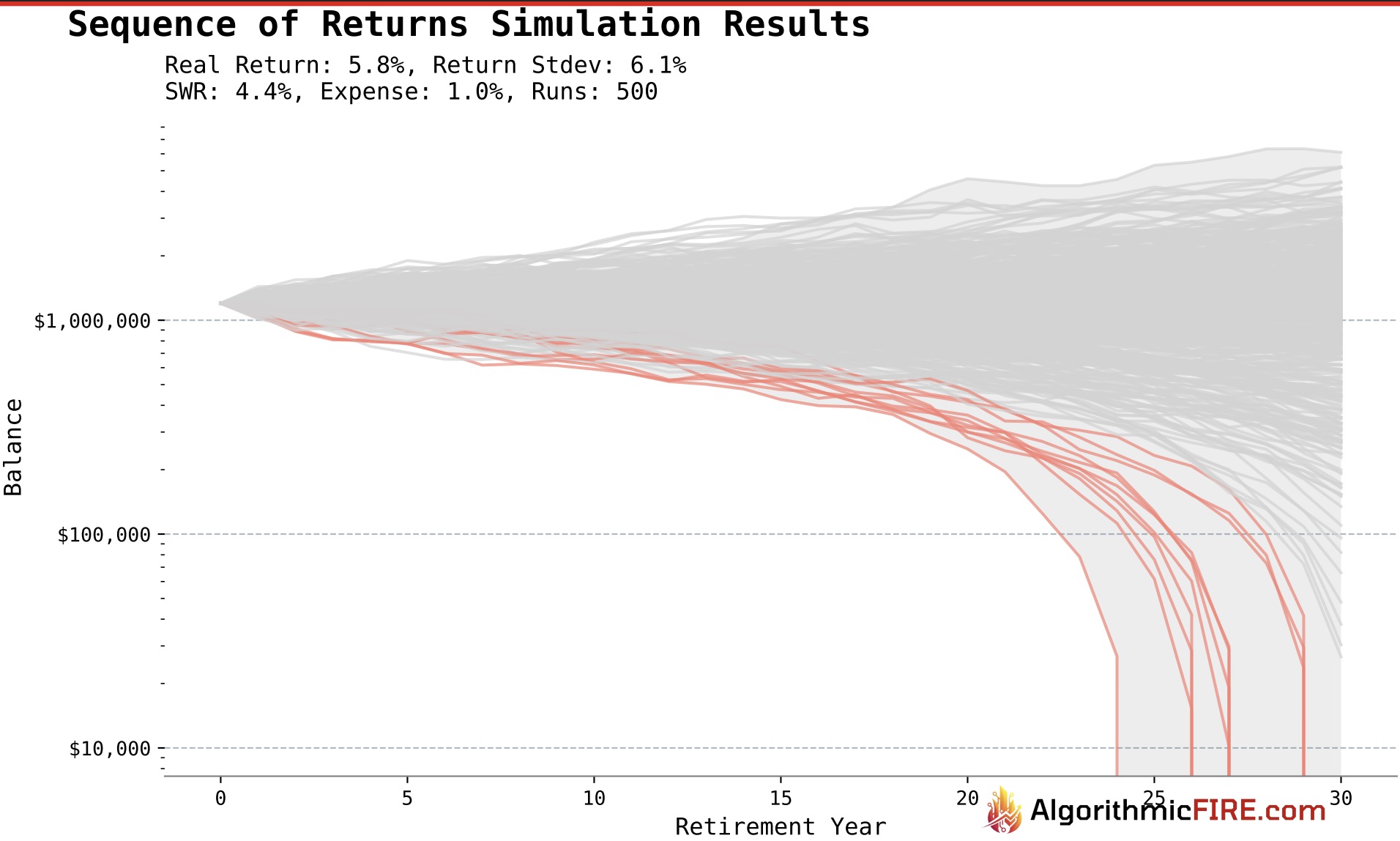

The simulation is again a Monte Carlo simulation of 500 runs, similar to above, but now we are withdrawing money from the portfolio. This time we will look at the time series of portfolio balance for each run, instead of histograms of final wealth.

The first chart above is without the advisor, the second chart is with the advisor. For the second chart, we adjusted SWR down to 4.4% to achieve a similar number of failures (zero balance) as the non-advisor simulation.

- SWR without advisor: 5.0%

- SWR with advisor: 4.4%

(Note that you don't have to reduce the SWR a full 1% to achieve a similar number of failures. The reason is because the expense amount gets smaller as you lose money, whereas the withdrawal rate stays the same. Therefore, you don't need to reduce your SWR 1-for-1 to compensate for the advisor expense.)

Over a 30 year retirement period, that 0.6% of your portfolio is > $200K, and compared to the 5% income you are receiving, represents 12% of your income.

But Wait, There's More (Or Less Depending On Your Perspective)

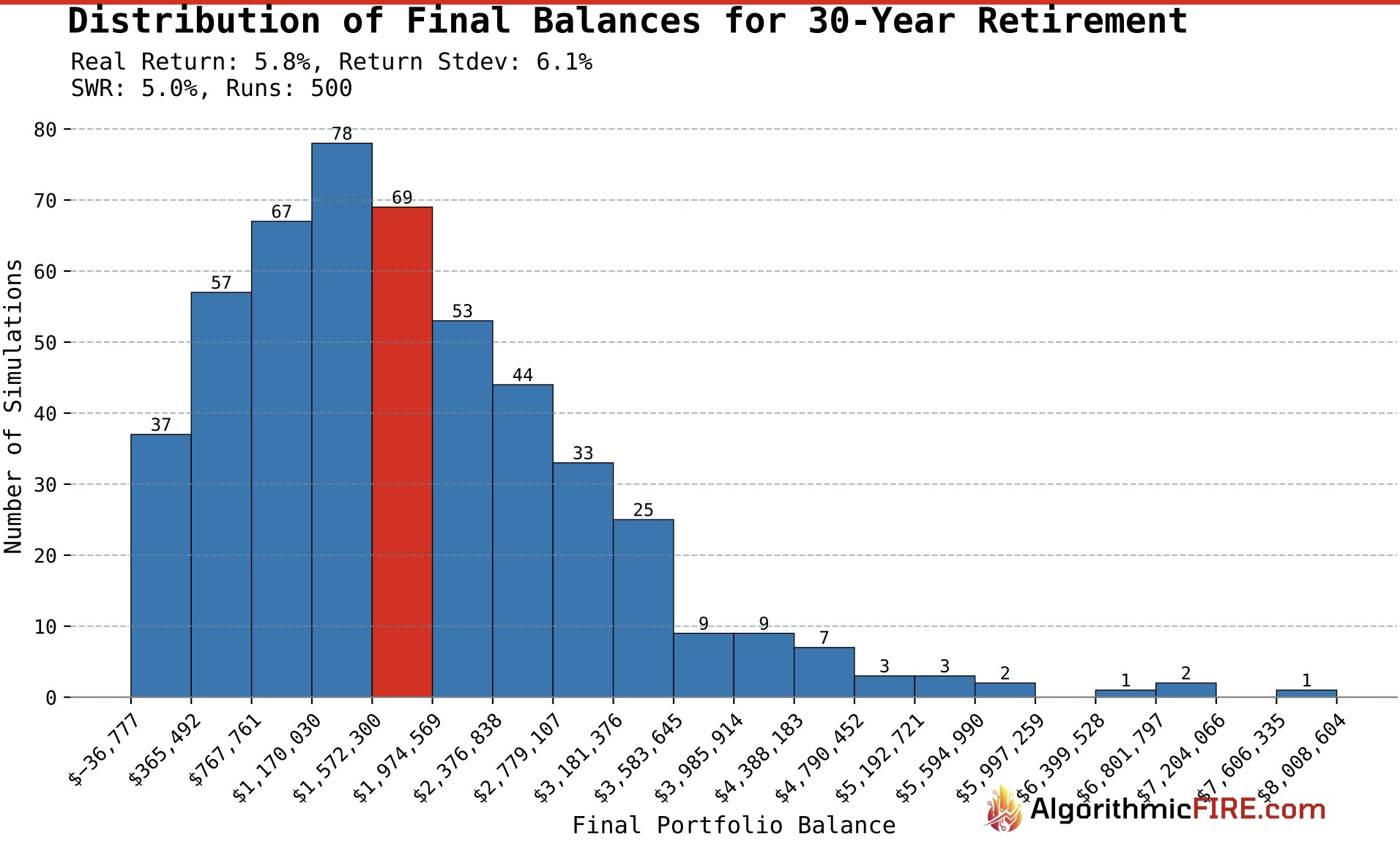

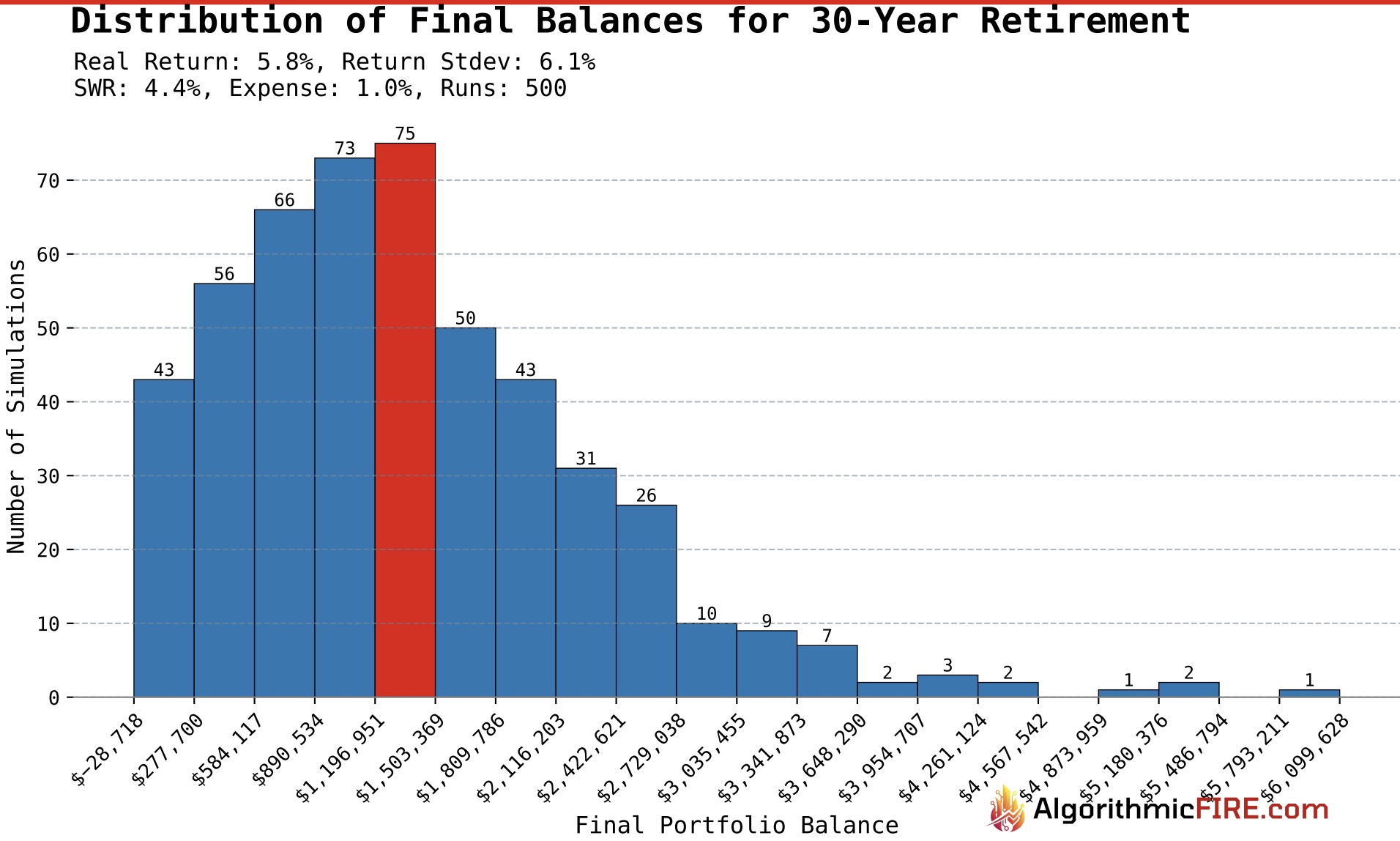

In the analysis above the SWR was adjusted such that the failure rate was similar between the two simulations. But, the resulting account balances at death were quite different.

The median final wealth without the advisor was $1.6M - $2.0M, with the advisor it was $1.2M - $1.5M. In this case you see the impact of the fixed 1% annual expense of the advisor truncate the results of the best case simulations

The impact to your final (legacy) wealth is $400K - $$500K. (Or, you can use a variable withdrawal rate to spend more while retired and pass on less wealth.)

Again - this is not saying that you paid the advisor the $400K-$500K. It is saying that the advisor cost you $400K-$500K in terms of the returns you received due to reduced compounding.

Conclusion

We modeled a savings plan that would result in a median final wealth of $1.0M - $1.5M; a typical target for FIRE.

The net cost of an advisor, using our assumptions, is:

- $200K-$300K during wealth accumulation.

- A lower SWR of 4.4% instead of 5% (no advisor); which results in lower income by $200K or more during retirement.

- And $400K-$500K less at death. (Or the option to use a variable withdrawal rate to spend more while retired.)

In the title we said the advisor fees "will be measured in hundreds of thousands of dollars". It is really closer to $1M, and in best case investing scenarios, much more.

The solution: Don't use an advisor. Buy the ETFs yourself, and save the money. If you don't know how to do this, we will recommend a starting point: The Little Book of Common Sense Investing

This book is a quick read, two hundred and some pages, in a small format. It is a great starting point for understanding the basics of investing. Here is a description:

"Wiley's describes The Little Book of Common Sense Investing by John C. Bogle as a guide for long-term wealth building using low-cost index funds, advocating for a simple buy-and-hold strategy that captures market returns by minimizing fees, avoiding market timing, and understanding that costs erode long-term gains. Bogle, founder of Vanguard, argues that trying to beat the market is a "loser's game" and his book offers a proven, simple path to investing success for all levels of investors."

Full Disclosure - the above is an affiliate link and we will receive a small commission if you purchase the book.

Addendum - Other options

- If you use an advisor, once your portfolio is larger than $1M, you should start inquiring about reducing the fee structure, as some advisors will offer a discount for larger portfolios.

- Use a prebuilt portfolio, a target-date fund, or a robo-advisor.

- Example: ETrade has prebuilt portfolios. These are available as: aggressive, moderate, conservative, and income. Each has a small number of ETFs, designed to fit the portfolio description. You select your account, select the portfolio, and they populate an order to buy the ETFs for you.

Ready to learn more?

See a list of recent blogs on our home page.

Or, dive deeper into investing, saving, and withdrawal strategies through our comprehensive Curriculum.

Subscribe now to get:

- Our new blogs delivered straight to you via email.

- Access to all historical blogs. (Only recent posts are availble to non-subscribers.)

- Access to videos and all of our calculators.

- Access to all blog content as a downloadable PDF.

- Access to our Dashboard with trend following results.

Thanks for reading! Feel free to share this post, and follow us on social media:

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025-2026 Algorithmic Fire LLC. All rights reserved.