In this post we will show you how to use our calculators to create a savings plan, and a withdrawal plan. We will work through two examples. First, we start with a savings plan, and then determine a withdrawal plan. Second, we start with a withdrawal plan, and then determine a savings plan that supports the withdrawal plan. When we are done, you'll understand how to use our calculators to create your own plans.

Forward vs Backward Planning

With forward planning, you start with your current savings, annual contributions, the amount by which you expect to grow your contributions each year, and your retirement age. You forecast out your future savings balance at retirement, then decide on a withdrawal strategy, and that determines how much income you will have each year in retirement. Forward planning works well in these cases: * You are young, and have a long time to save. * You know how much you can save, and when you want to retire. You want to know how much income you will have in retirement.

With backward planning, you decide on a retirement income target, then work backwards to determine how much you need to save each year to achieve that income target. This approach assumes you have more control over how much you can save each year, and that you have the discipline to decide to save more each year to achieve your retirement income target. Backward planning works well in these cases: * You are older, and have a shorter time to save. (That is, your savings is already largely determined because you are close to retirement.) * You know how much income you want in retirement, and you want to know how much you need to save each year to achieve that income target.

Neither method is better than the other; they are just different. We will walk through using our calculators to cover both methods.

The examples aren't meant to be prescriptive; they are just examples. Our goal is to show you how to use our calculators to create your own plans.

Real vs Nominal Returns

Reminder that we will be using real returns for our calculations; read the link if you need a refresher. (Real returns are the returns you earn after accounting for inflation. This keeps the purchasing power of your money constant. I.E. $1M today has the same purchasing power as $1M when you retire, even if that is many years in the future.)

Forward Planning Example

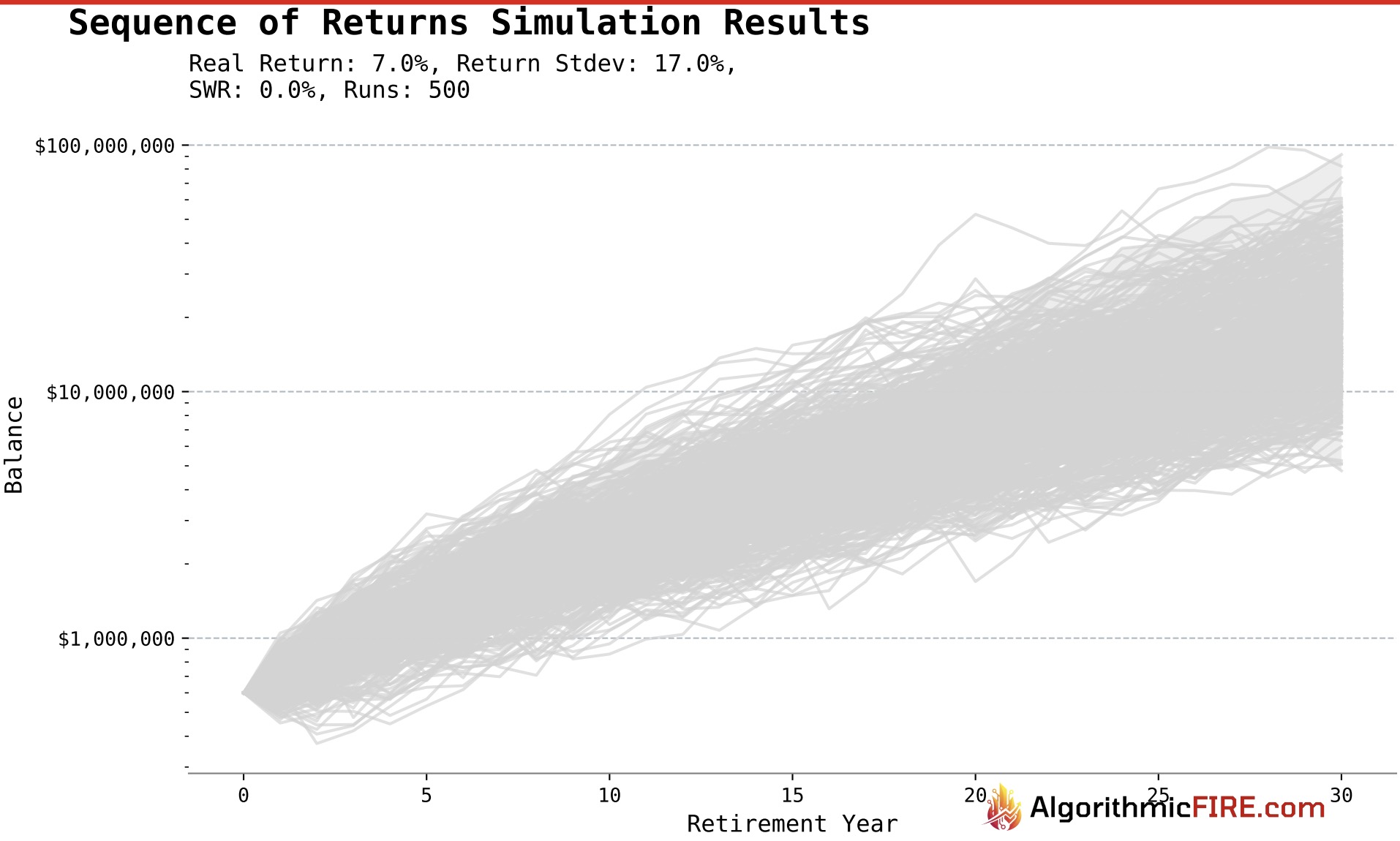

Quinn is 35 years old and has $100,000 in savings. Quinn plans to save $10,000 per year, expects to grow her contributions by 2% per year (real growth), and plans to invest the savings in 100% stocks. (In our calculator we used 7.0% real return with a 17% stdev to approximate the S&P 500.) Quinn plans to retire at age 65.

Savings at Retirement - Forward Planning Example

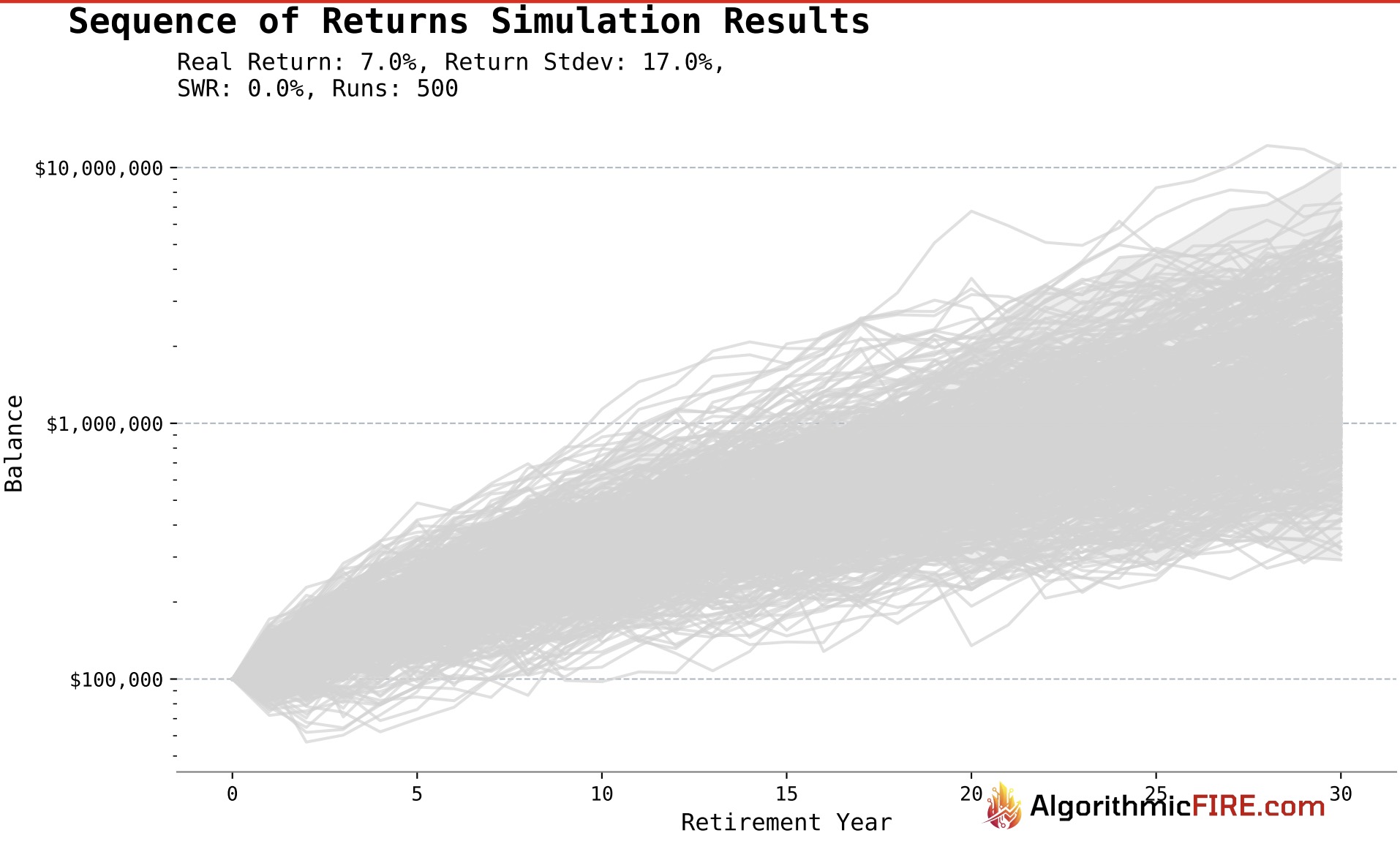

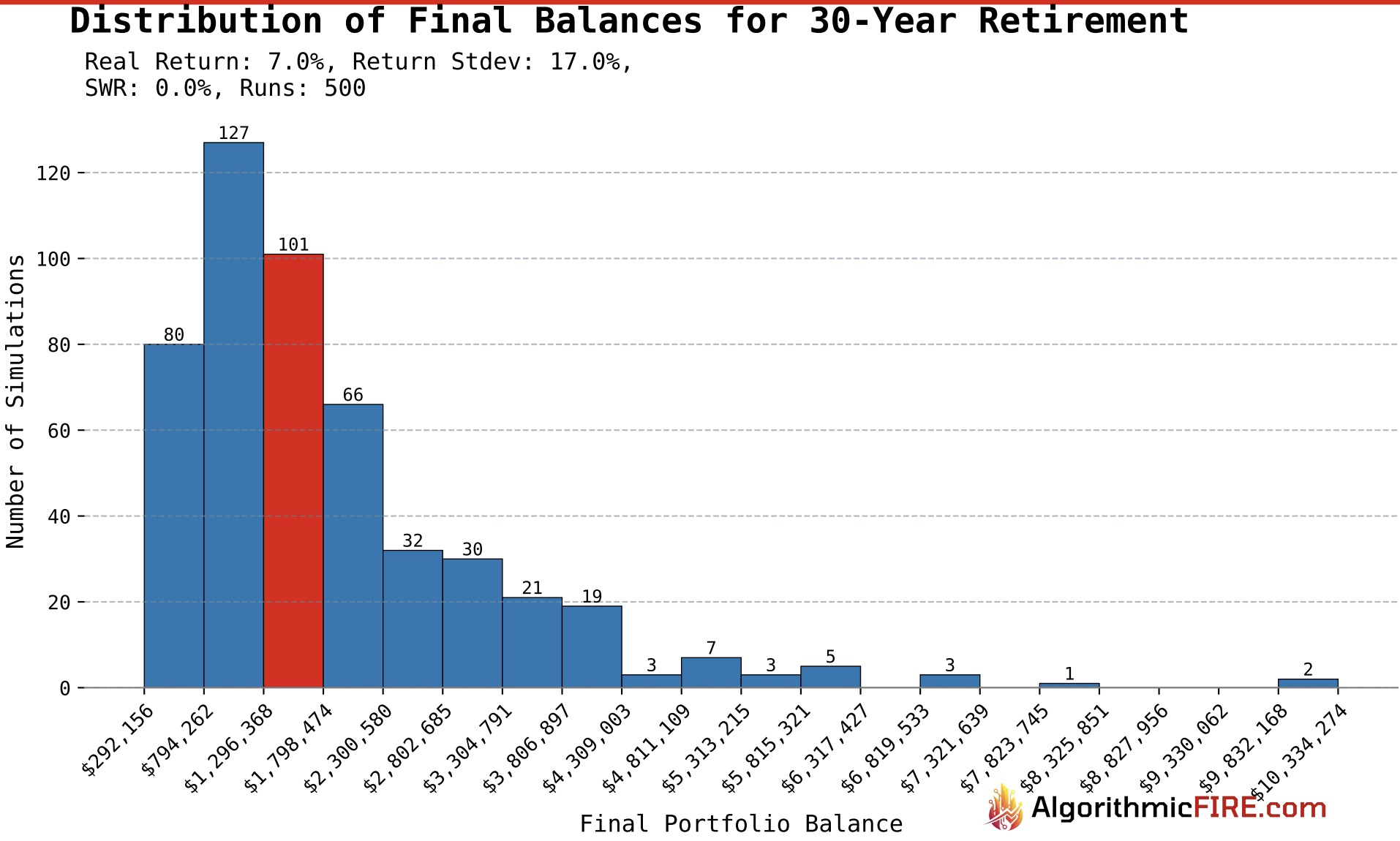

We put those values into our Portfolio Wealth Simulator, and it shows us the future value of her savings at retirement.

* Because stocks are volatile, the simulator shows a range of possible outcomes. The middle of the range is the most likely outcome, and the outer bounds are the least likely outcomes.

* The simulation shows a median of between $1.3M and $1.8M at retirement.

* The total range of outcomes is between about $300K and $10.3M.

* Because stocks are volatile, the simulator shows a range of possible outcomes. The middle of the range is the most likely outcome, and the outer bounds are the least likely outcomes.

* The simulation shows a median of between $1.3M and $1.8M at retirement.

* The total range of outcomes is between about $300K and $10.3M.

This is where you have to make some decisions regarding risk tolerance. Do you want to plan for the median, or a worst case? There isn't a right or wrong answer; just the answer you will be comfortable with in 30 years time. * You might decide you need to save more to ensure the retirement you want. * Or you might decide that this is all you can do, and you'll take what comes as a result.

Withdrawal Strategy - Forward Planning Example

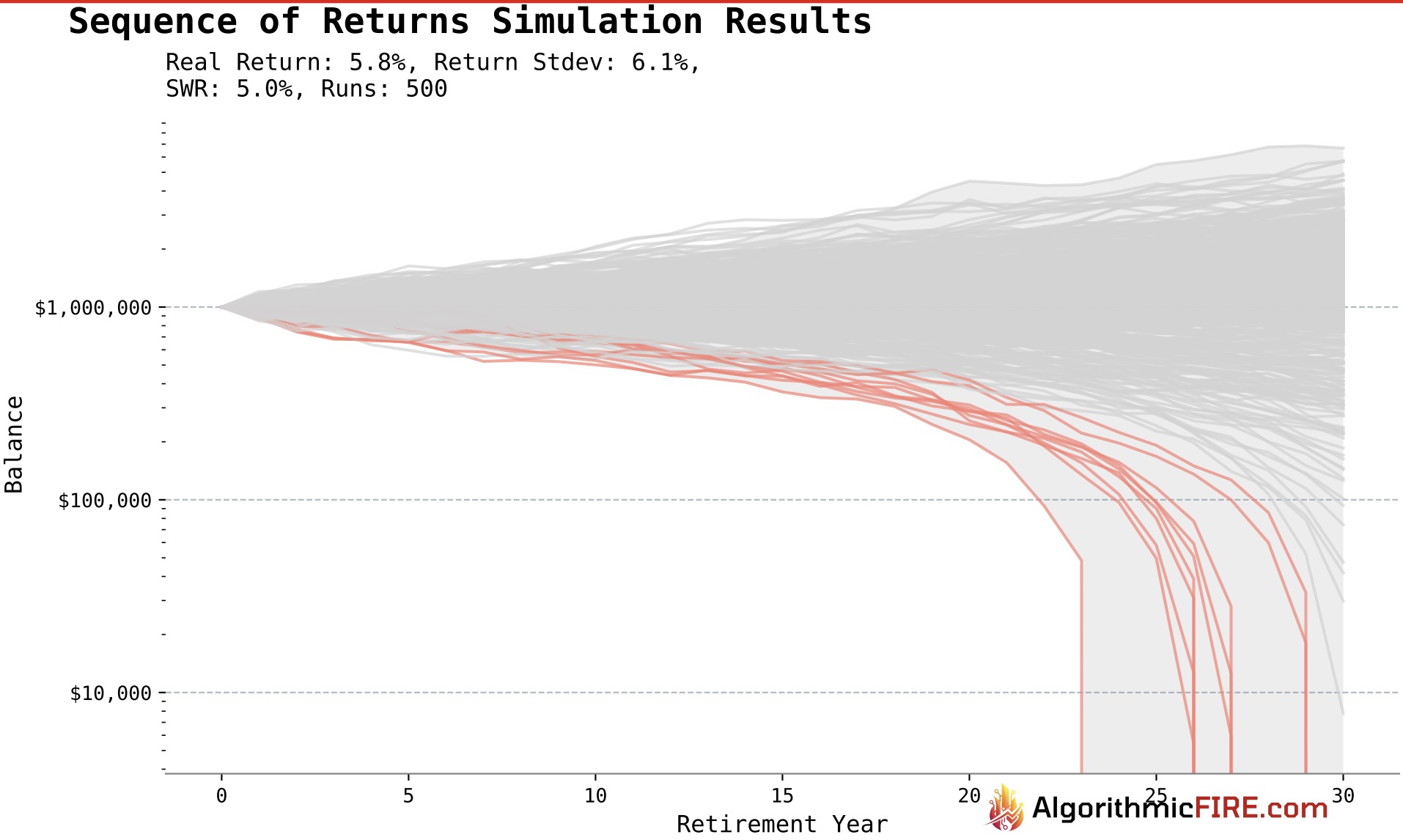

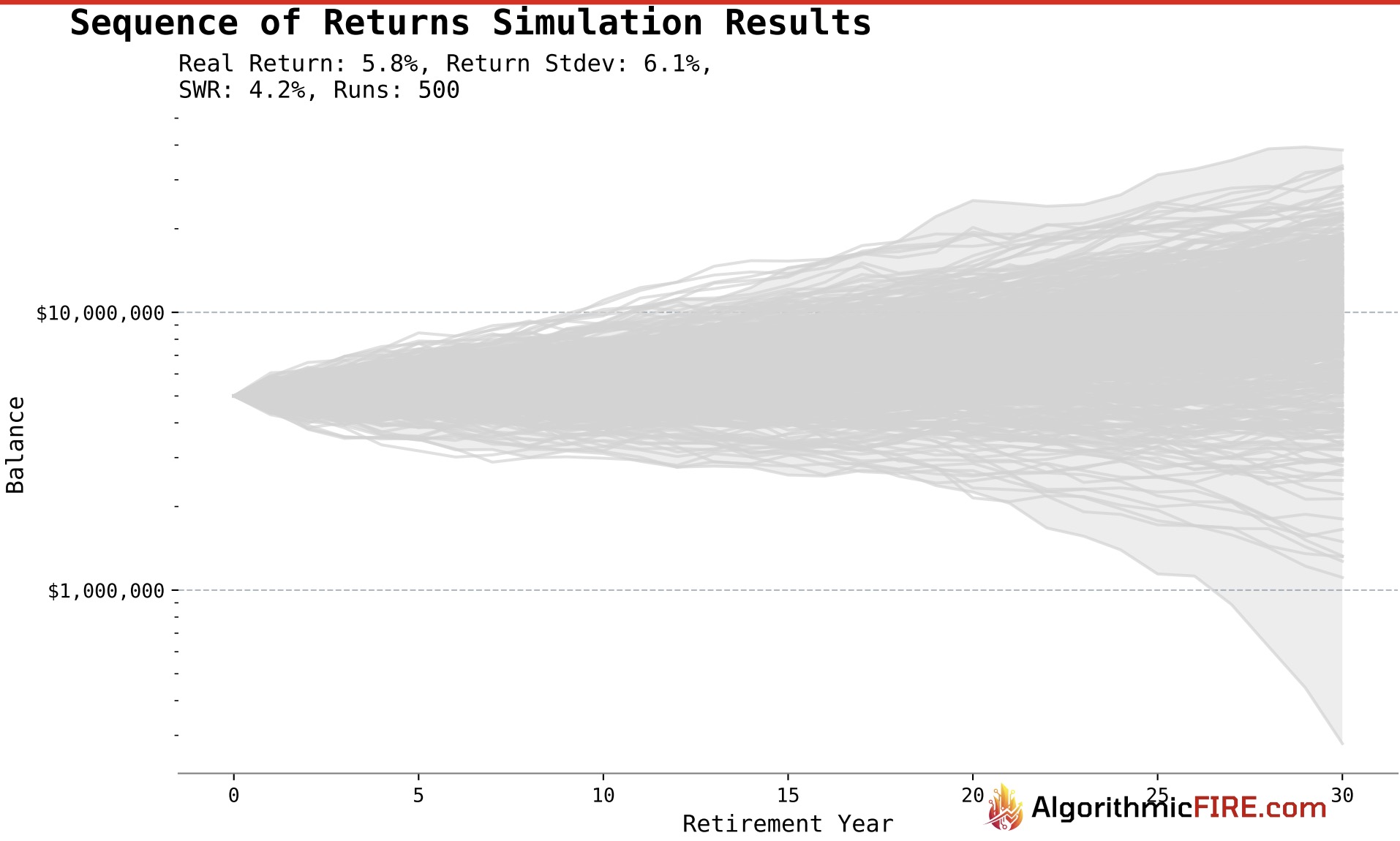

For this example, we will have Quinn plan on a savings of $1M at retirement; below the average, but well above a worst case. Once in retirement, Quinn will invest the portfolio in 50% stocks and 50% investment grade corporate bonds. (In our calculator we used 5.8% real return with a 6.1% stdev to approximate the portfolio.) Quinn has decided on a fixed withdrawal rate of 5%.

The results of this withdrawal strategy show about 10 of 500 cases where Quinn runs out of money before death; Quinn is comfortable with this risk. * The result of this saving and withdrawal strategy is an income of $50K/year in retirement.

To be clear, nothing is certain here. * There were assumptions made regarding risk during the savings period, and during the withdrawal period. * This withdrawal strategy is a simple fixed withdrawal rate. + We cover more advanced withdrawal strategies in our post Variable Withdrawal Rates Enable Increased Retirement Income; those could be used to increase the income Quinn receives in retirement, thereby reducing account balance at death. But variable withdrawal rates also increase the risk of either a period of reduced income or running out of money. * Consider these results a guide to what could happen, not a prediction of what will happen.

Reverse Planning Example

Jordan is also 35 years old, but has much more flexibility in planning than Quinn. Jordan currently has a high income, and foresees significant increases in their income in the future. Jordan wants to ensure a high income in retirement, but also wants to understand what the trade-offs are regarding quality of life now.

Withdrawal Strategy - Reverse Planning Example

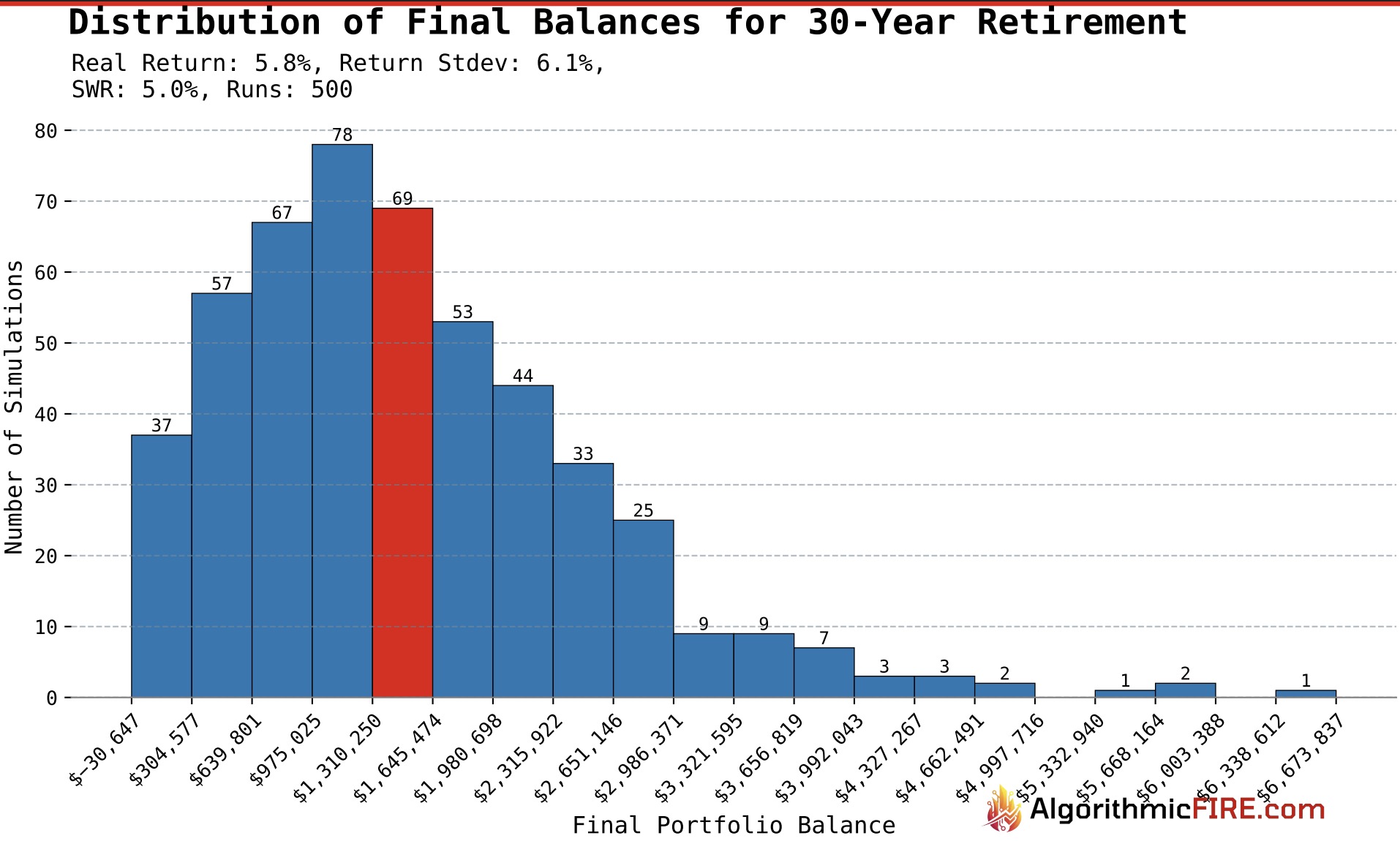

Jordan wants to plan for a retirement with income of at least $200K/year from their portfolio. Jordan plans to retire at age 65. (Jordan will use the same saving and retirement investment strategies as Quinn; 100% stocks during the savings period, and 50% stocks and 50% investment grade corporate bonds during the withdrawal period.)

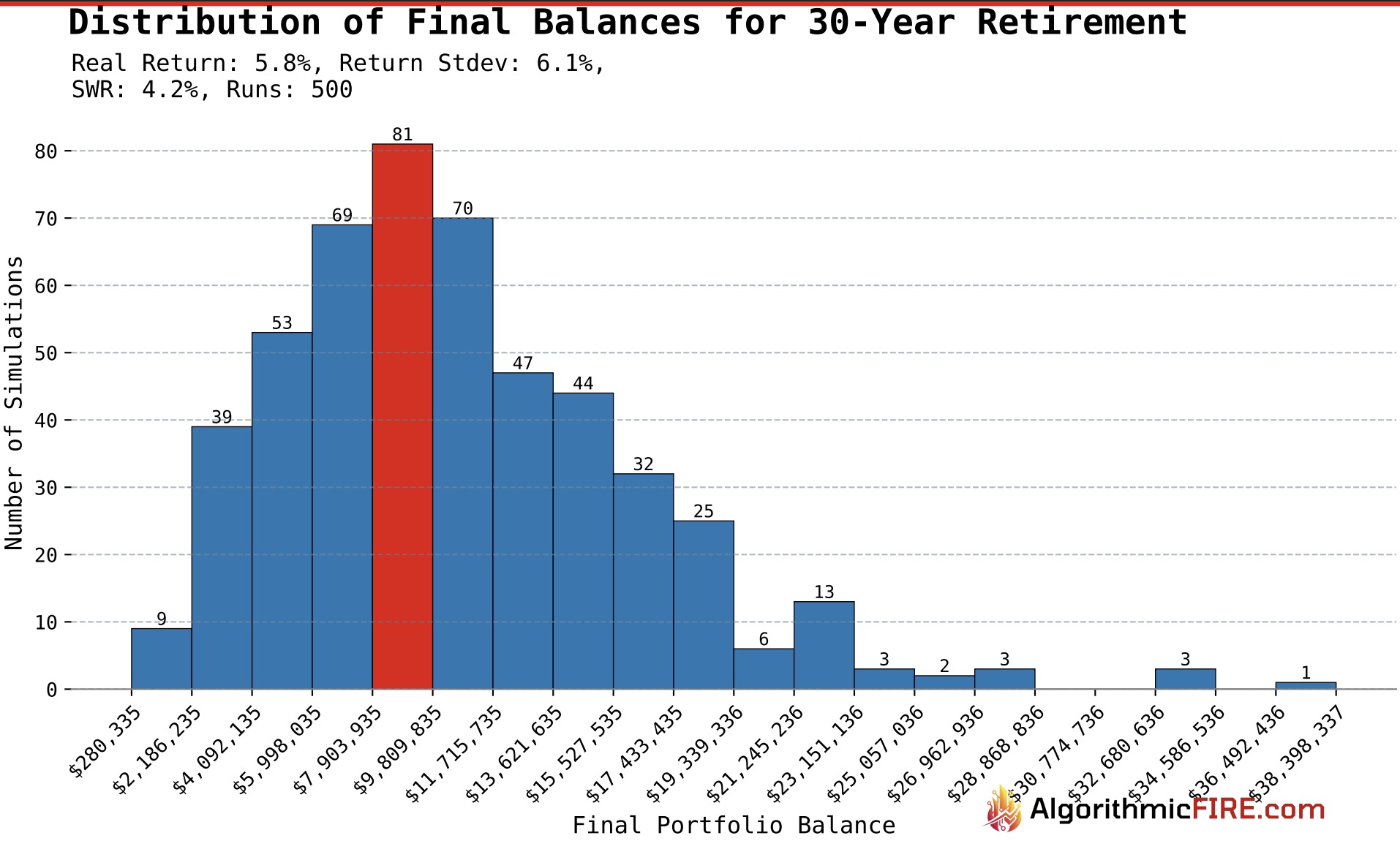

* Jordan chose a fixed withdrawal rate of 4.2%. This is lower than Quinn's withdrawal rate of 5%, but Jordan is more risk averse, and doesn't want to see any failures in the simulation.

* This means Jordan will need to save at least $4.8M at retirement, but they chose to round up to an even $5M

* Jordan chose a fixed withdrawal rate of 4.2%. This is lower than Quinn's withdrawal rate of 5%, but Jordan is more risk averse, and doesn't want to see any failures in the simulation.

* This means Jordan will need to save at least $4.8M at retirement, but they chose to round up to an even $5M

Savings at Retirement - Reverse Planning Example

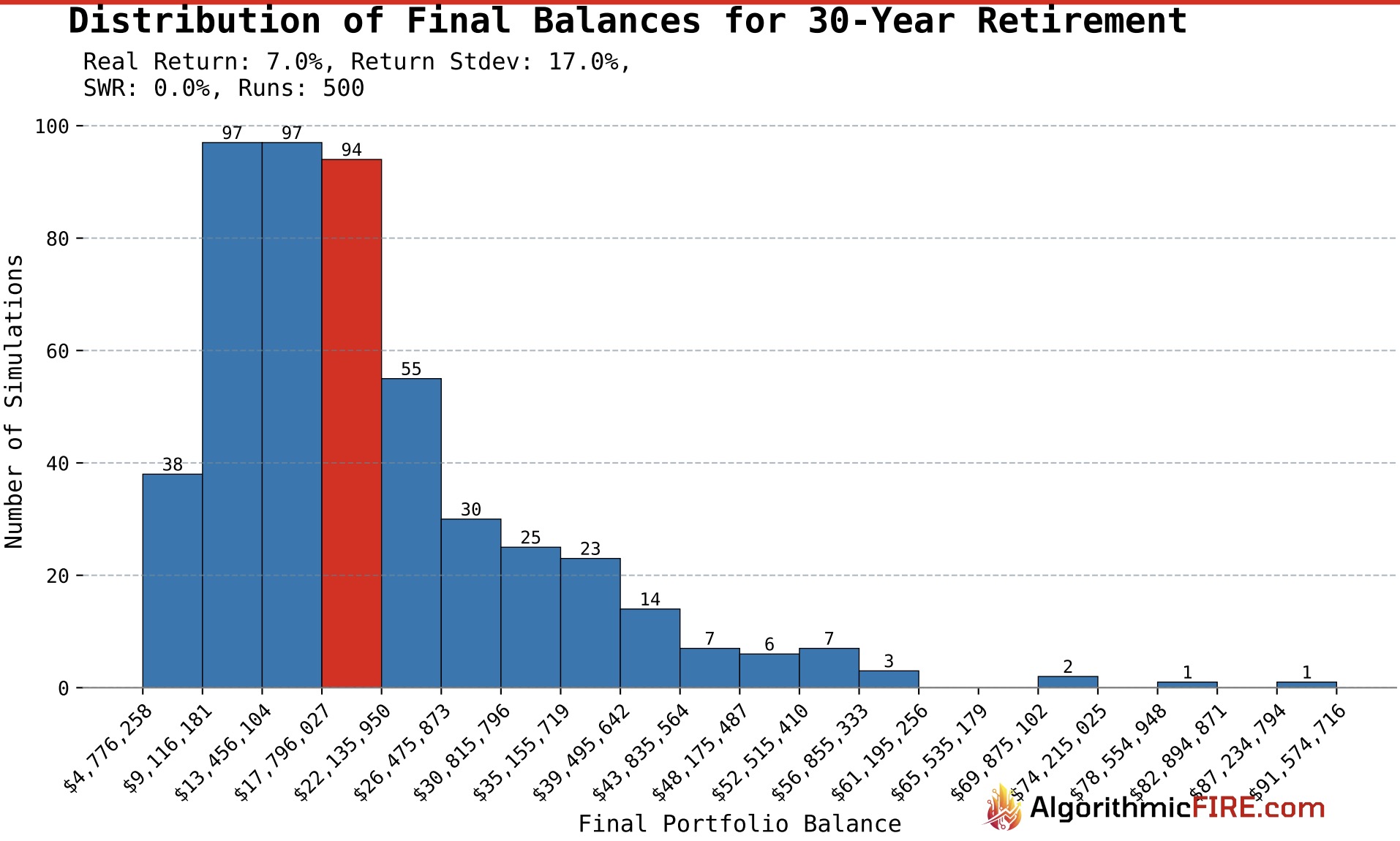

So what does it take to have $5M at retirement? Jordan currently has $600K in their portfolio. To get to a worst case $4.8M at retirement, Jordan will need to: * Save $80K/year. * Grow that savings at a real rate of 7%/year. * Save for 30 years.

- Again, because stocks are volatile, the simulation shows a wide range of outcomes for savings at retirement.

- After an initial period of high savings, if the market performs well, Jordan could reduce the savings rate in order to achieve a higher standard of living now, while still targeting their retirement goal of $5M.

This is the power of compound interest; early savings can generate significant sums over long time periods. By starting with a high rate of savings, and getting those funds invested early, Jordan will likely be able to reduce their savings rate in the future, while still meeting their retirement goal. But, if Jordan is unlucky, and the market performs poorly, they will need to continue saving at a high rate to meet their retirement goal. We discussed this in our post How Much Retirement Savings Can Be Accumulated with 30 Years of Saving $1000/month?.

Takeaways

- You can plan forward, and plan backward. Choose what suits you best.

- There are risks during both the savings and withdrawal periods.

- Nothing is certain; planning is only a guide to what could happen, not a prediction of what will happen.

- These simulations used fixed withdrawal rates, but variable withdrawal rates could be used to increase income in retirement, or to reduce account balance at death.

- Failure to plan is the only failure.

We now have online calculators that can duplicate most of our analyses.

Run them to see the results for whatever scenario(s) you prefer.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe now to get all our content delivered straight to you via email.

Thanks for reading! This post is public so feel free to share it, and follow us on social media:

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.