The AlgorithmicFIRE Curriculum Review

Our blogs provide comprehensive resources to the math, the risks, and the strategies of Financial Independence/Retire Early (FIRE). In our Curriculum Review we provide a summary of all our posts to quick-start your journey.

Read Article Watch Video SummaryFinancial Tools

Portfolio Simulator

Simulate wealth accumulation and sequence of returns risk using Monte Carlo simulation.

Launch ToolSafe Withdrawal Rate

Calculate your safe withdrawal rate for retirement based on expected investment returns and other factors.

Launch ToolTrend Following

Utilize reports from our trend following strategies to reduce drawdown and manage risk.

Go to DashboardBuying Insurance for Your Portfolio: Put Options vs. Trend Following

Trend following isn't the only way to protect against downturns. We compare trend following to the "guaranteed" protection of put options, and calculate the true cost of that certainty using SPY as our proxy for the S&P 500.

Read Article Watch Video SummarySimplified Roth Versus Traditional IRA Conversations May Be Costly

The discussion is frequently reduced to comparing your current tax bracket to your expected tax bracket in retirement. While simple, this comparison is incomplete.

Read Article Watch Video SummaryCan You Afford an Investment Advisor?

The question isn't whether you can afford an advisor, but whether the long term costs of an advisor are worth the money; which will be measured in hundreds of thousands of dollars.

Read Article Watch Video SummaryHope Is Not a Strategy; Retirement Takes Planning

You must have a savings plan, and a withdrawal plan; either can come first. We will show you how to make both plans so you have a clear path to retirement.

Read Article Watch Video SummaryCapital Gains Tax Impacts on Trend Following Strategies

Retirement accounts are generally tax deferred, but if you have taxable accounts you should be aware of the tax implications of increased trading frequency.

Read Article 🔒Subscribe to WatchDefending Your Savings Against Significant Downturns

What happens if the market doesn’t just "dip," but stays down for a decade or more? We explore strategies to safeguard your savings from prolonged stagnation.

Read Article Watch Video SummaryU.S.-Based Investors Think the Worst-Case Scenario is the Great Depression or GFC. Other Countries Disagree.

When investment planning for retirement, it is important to consider all possible outcomes. We take a look at Japan in the 1990s to redefine "worst case".

Read Article 🔒Subscribe to WatchThe 4% Rule Is Dead, Here's What's Replaced It

The 4% rule, which we wrote about in our post regarding Safe Withdrawal Rate, was established back in 1994. Since then, many alternatives have been suggested. We review the major alternatives.

Read Article 🔒Subscribe to WatchVariable Withdrawal Rates Enable Increased Retirement Income

But why do they work? Why not just start with a higher withdrawal rate?

Read Article 🔒Subscribe to WatchHow Much Retirement Savings Can Be Accumulated with 30 Years of Saving $1000/month?

Historical analysis shows luck plays a huge role

Read Article 🔒Subscribe to WatchIt's OK to Put Off Retirement Savings Until You're Older - It's Easier Then...

Except it's not. It is actually harder, unless you get lucky.

Read Article 🔒Subscribe to WatchDoes Using a Safe Withdrawal Rate Mean I Likely Die With No Money?

No, in fact, you are likely to leave behind substantial assets. Plan for it.

Read Article 🔒Subscribe to WatchYour Index Investments Likely aren't as Diversified as You Think

Large cap indices are dominated by a few large stocks. What to know and how to get more diversified.

Read Article 🔒Subscribe to WatchSafe Withdrawal Rate For Shorter Retirements

Not everyone needs a 30 year retirement. How does Safe Withdrawal Rate change for shorter retirements?

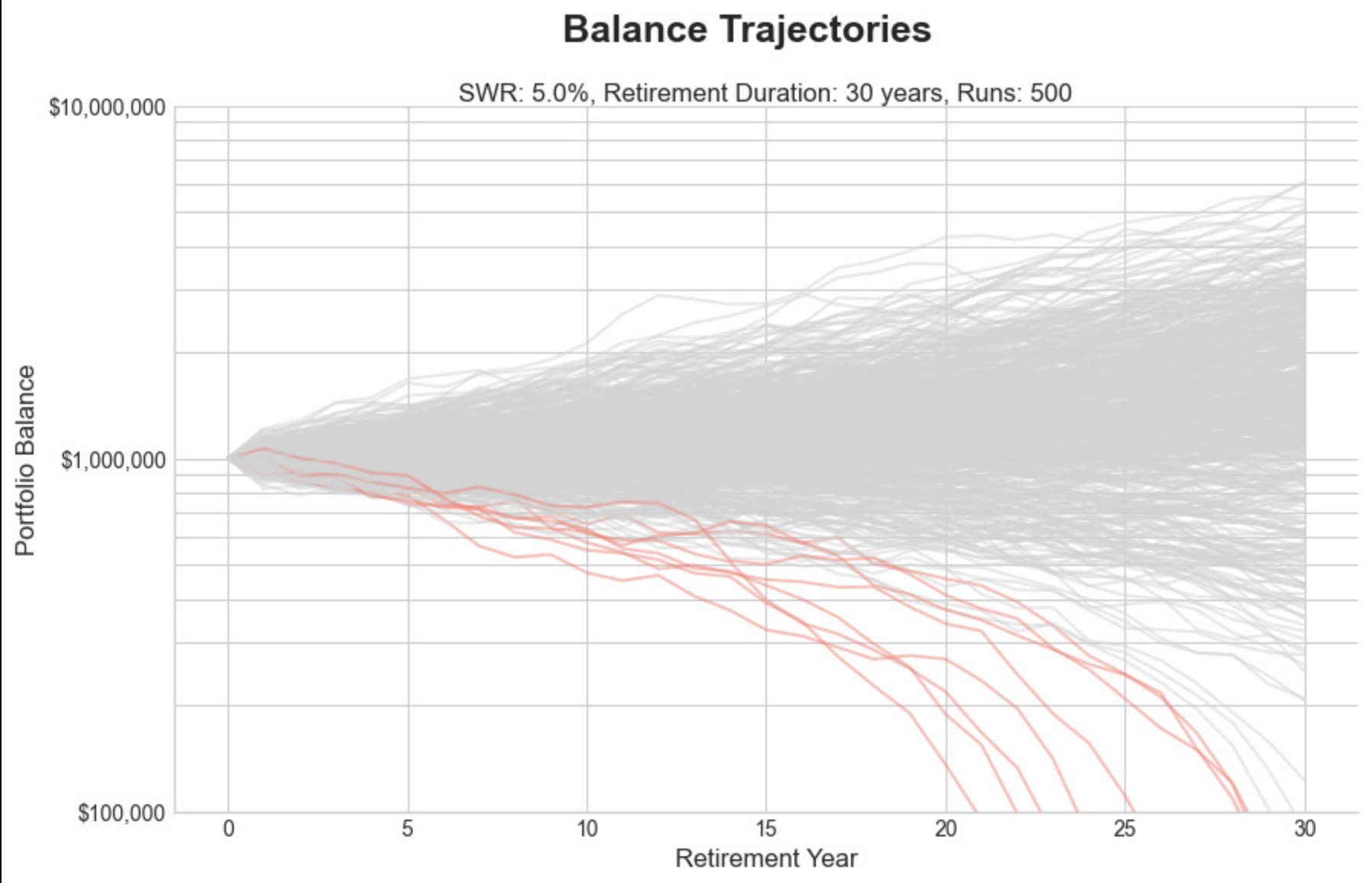

Read Article 🔒Subscribe to WatchSafe Withdrawal Rate Failure

What happens if your Safe Withdrawal Rate (SWR) is too high? A look at history and some tips for recovery.

Read Article 🔒Subscribe to WatchUnderstanding Safe Withdrawal Rate

Safe Withdrawal rate (SWR) is the key to answering “Am I (financially) ready to retire?”

Read Article Watch Video SummaryUnderstanding Sequence of Returns Risk

A critical risk factor that can make or break your retirement portfolio, regardless of average returns

Read Article Watch Video SummaryAverage Return - It’s Not What You Think

Compound Annual Growth Rate (CAGR) is the proper way to express investment returns over a period, not (arithmetic) average

Read Article Watch Video Summary